Features

Smart Money with Arese: Balling on A Budget

Being financially responsible doesn’t have to be boring! Let’s be real, no one works hard, day in day out, endures Lagos traffic, bills, bills and more bills so they can suffer! We work hard so that we can enjoy the nice things life has to offer. ‘Who no like better thing’ but sometimes we go about it the wrong way because we have an abusive relationship with money.

Being financially responsible doesn’t have to be boring! Let’s be real, no one works hard, day in day out, endures Lagos traffic, bills, bills and more bills so they can suffer! We work hard so that we can enjoy the nice things life has to offer. ‘Who no like better thing’ but sometimes we go about it the wrong way because we have an abusive relationship with money.

In the words of Kevin Hart…. ‘Let me explain’! Investing is like dieting, for it to be sustainable it has to be a part of your lifestyle. For example, my love affair with ‘starch and banga’ is legendary but I know if I eat it everyday I will be obese. (Trust me, the struggle is real!) Therefore, I TRY to make healthy food choices most of the time, so I can earn the right to enjoy my ‘starch and banga’ on cheat days.

This is just like investing in your financial freedom. You must have the discipline to set aside a proportion of your income every month (20%) towards purchasing assets (long-term financial goals), so that you can earn the cheat days that are your short-term financial goals (10%, the proportion of your income you set aside towards those seemingly frivolous expenses).

The key is understanding that you can have ANYTHING you want but not EVERYTHING you want! You need to decide what you value in life and ruthlessly cut expenses on the things that don’t matter to you so you can spend on the things that do.

Ivie doesn’t particularly fancy expensive watches? Simple! She doesn’t over spend there! But she loves holidays because they help her avoid burn out and create an escape from the reality that is Lagos life. So, she makes travel her SFG (10%) of choice and contributes a percentage of her income every month towards making that happen. It’s a smart way of allocating money for big purchases over a period of time instead of impulse buying.

Therefore learning to be smart with your money is not about extreme frugality. It’s about making intelligent decisions that allow you strike a balance between building wealth systematically and enjoying a lifestyle that your income can support.

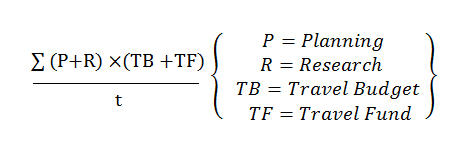

There’s a science to balling on a budget!

Actually, I kid! (I’m not a mathematician) it’s more of an art! These are 5 steps that’ll help you get there without breaking the bank.

Create a travel vision board

If you were financially on top of your game and you could visit any country in the world, where would it be? Which hotels would you stay at? What activities would you take part in? Where would you go shopping?

Just because you can’t afford something today doesn’t mean you can’t dream about it! You can attract anything you focus on and believe in. Plus, dreams give you something to look forward to while you are working hard. So, using images and words create a vision board of what your ideal holiday would look like.

Scale it down

Maybe, your name is Arese and your ideal holiday is lying on a beach in the South of France, yachting in St. Tropez and eating food with names you can’t pronounce but after a realistic assessment of what is achievable a year from now, you put that on the back burner and create an intermediate goal that mimics certain aspects of your original goal but costs less i.e. lying on Bojo beach, Ghana eating ‘banku’.

Plan!

Everything is expensive but it’s more expensive when you don’t plan. So people who make last minute purchases on tickets and hotels tend to pay more than people who planned ahead.

For example, on a Virgin Atlantic flight in July, Tunde is sitting in economy (ticket N400k) looking at Musa in Premium economy (ticket N400k) thinking ‘that guy get money o’ not realizing that Musa bought his ticket 6 months prior, in anticipation of the yearly hike in ticket prices in the summer time. Worse still, he is sitting next to Morenike in economy who also planned ahead. (ticket N250k).

Down the aisle is the crown prince of the ‘air miles gang’ Niyi, sitting in upper-class who is an advocate of sticking to one airline so he can rack up his miles and bought a premium economy ticket months earlier but used his miles to upgrade to upper class. So who was smarter with their money? Ultimately, price is what you pay but value is what you get.

Research

We tend to make assumptions about how expensive things are, instead of doing the research to figure out which options give us the best value for our money. This is what my brother and I often refer to as ‘price fear’.

For example, scouting for deals on booking.com and hotels.com for your holiday to New York could mean paying 4 star hotel prices for 5 star hotels, i.e. paying less for the Trump (Central Park) than you would the Hilton (Midtown). For holidays in Africa, I recently discovered @africholidays on Instagram; they offer package deals for amazing prices.

Start a travel fund

All the vision, planning and research in the world mean absolutely nothing if you can’t put numbers to it! Create a travel budget that provides a rough estimate for what your holiday will cost. Then, make a commitment to save a proportion of your income (10%) towards this goal each month.

Saving towards a goal can be tricky, so it might be helpful to open a targeted savings/investment account. The goal is not to become a billionaire from this particular short-term investment but to give you the discipline required to reach your goal while making sure your money is working as hard as it can.

It helps to save early because the longer the time span, the less impact the monthly contributions will have on your income and save automatically by setting up a direct debit with your bank for your monthly contributions.

Even if you are going to your village the rules still apply. i.e. my nanny, Patricia is from Akwa Ibom and its important to her to travel at Christmas, to visit her family so we have a ‘village fund’ to make sure she doesn’t spend all her life savings and come back broke, to start looking at me with ‘googly’ eyes.

We live in a society where all fingers are not equal. So obviously, there’ll be people whose incomes can legitimately support going on an expensive holiday on a whim and that’s great but there will also be people who make financial mistakes like taking a loan to go on a holiday but that’s none of my business! For the rest of us…. There’s balling on a budget!