Career

Smart Money with Arese: Nigerian Women & Money – Part 2 | For the Single Girl

This month I’ve decided to write a 3 part series called Nigerian Women & Money. One article each week. Part 1 is for the Stay at Home Mum: run your home like a corporation. Part 2 the Single Woman: Be a Boss, Build an Empire. Part 3 Working Mother (9-5er/ entrepreneur): Be Superwoman.

This month I’ve decided to write a 3 part series called Nigerian Women & Money. One article each week. Part 1 is for the Stay at Home Mum: run your home like a corporation. Part 2 the Single Woman: Be a Boss, Build an Empire. Part 3 Working Mother (9-5er/ entrepreneur): Be Superwoman.

***

Tinuke makes N10m from a contract. She’s excited and wants the world to know she’s arrived, so she’s thinking, now I can afford all the things they said I couldn’t have. She buys a car (N4m), she moves into a flat in Lekki phase 1 (N2.5m p/a). That Ada girl has a Chanel bag collection to die for, so I can’t buy ‘ordinary’ Chanel, I have to buy Hermes (N2m). ‘won ma gba’. This iPhone 5 is no longer ‘it’, I have to upgrade to an iPhone 6+. *insert Jennifa hand gestures*.

At this point, she remembers that ‘they said it’s good to invest’, so she puts N200k in a fixed deposit. She figures she’s good; after all she still has an income of 150k coming in every month, so what was left would be more than enough to survive.

However, her new ‘millionaire’ status means that, when her friends invite her out, she can’t ‘slack’! She has to look the part, dress the part and spend the part. Eight months later, when she has to liquidate her fixed deposit and borrow money from Sade to pay her mechanic and service her generator. She is back to living from paycheck to paycheck and soon realizes that, Louboutin is an expensive habit.

This is NOT a judgment against expensive cars, Chanel bags or Louboutin shoes. Trust me, I LOVE these things too. It is about a lack of understanding, when it comes to how money works. I believe in spending your hard earned money on the things you like, and finding a balance by accumulating assets along side them.

Let me explain! If you make N10m and you spend N10m, what you have left is zero. People might perceive you as rich but you are no longer ‘in the money’ because you have spent it all, with the hopes that you will make more. Maybe you do, maybe you don’t but it becomes a never ending, fruitless cycle of spending more than you earn.

This stems from one simple fact. We grow up knowing we need to make money to be successful, but we are not taught in any formal framework, how to manage our finances. So as a result we know how to make money, but not how to keep it, build it or grow it.

I point this out not because it doesn’t apply to men, but because women with money and women with power are two ideas our society is uncomfortable with. Therefore, it has become extremely important to empower women by teaching them how to spend and invest to ensure that they build wealth that lasts.

What the single girl needs to learn about money to get ahead

You are probably in your mid 20s, out of university, decent starter job, living at home with no real responsibilities. You feel like your whole life is ahead of you, so investing and saving can come later. The truth is there is no better time than now to set financial goals and learn about what investment opportunities are available to you.

Get Money

In order to maximize your earning power and have the ability to invest, you need to pursue a career you are passionate about and create multiple streams of income. This does not necessarily mean you have to become an entrepreneur. The reality is, not everyone is cut out to be ‘their own boss’ and you need to learn this early on. Being a boss is not about working for yourself and avoiding the discipline of a 9-5. It is about adding value and being a high performer, wherever you are. There are two ways to be stuck. (and you don’t want to be stuck in your 30s or 40s) Stuck in a 9-5 job you hate and stuck in an entrepreneurial role you can’t do. Turning your passion into a paycheck is more complex than it sounds. You need to figure out what comes naturally to you, than it does others. Just because you liked planning your wedding, does not a wedding planner make. Liking something doesn’t mean it’s your passion, being good at it and willing to do what it takes to sharpen your skills, is what will turn your passion to profit.

Create a Game Plan for Your Money

In order to take control of your money you need to devise a strategy that helps you allocate your resources efficiently and cultivate the habit of spending less than you earn and investing the rest in assets that generate income. (i.e mutual funds, real estate, money market products) The longer you leave your money invested the better your average annual returns will be, so time is on your side.

Change your Money Mentality

Again, if you earn a N100m and you spend a N100m, what you have left is zero. You need to derive the same amount of joy from investing, as you do the Pigalles 120mm, it hurts but it’s worth it right?

People are generally good at working hard and earning money but they are terrible when it comes to scaling their consumption. If you can spend N250k on shoes, you should be able to make N250k in investments to match it.

Establish your Net Worth

Aliko Dangote (yes, I’m a bit obsessed) is not the richest man in Africa because he earns $23.5bn as his salary. He is the richest man in Africa because his net worth (assets- liabilities) is $23.5bn. Therefore, building wealth is about using the money you earn to make more money by investing in building assets. For example, Tinuke makes N10m, invests N3m in land and spends the rest, assuming she has no liabilities and no other assets; Her net worth has gone from N0 to N3m. It’s not the number that matters but the progress. Set a goal to increase your net worth by 10% every year.

Your Budget is Your Friend,Not Your Foe

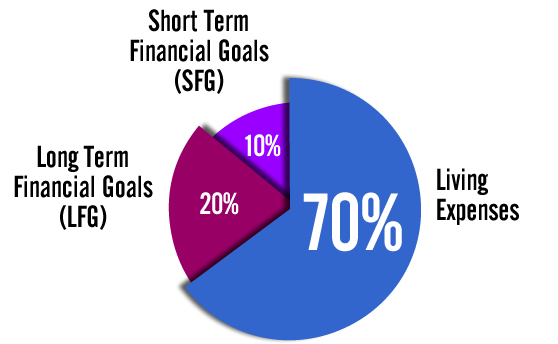

Stop thinking of a budget as something that restricts you; instead think of it as something that tells you all the things you CAN do with your money. An easy way to achieve this is dividing your income into three parts. Long-term financial goal, (20%) short-term financial goal (10%) and living expenses (70%).

Cultivate the habit of investing at least 20% of your income before you spend 1 kobo every month. It doesn’t matter if 20% of your income is N10, 000 or N100, 000 if you are saving and investing consistently you will definitely be richer in a few years than you are today.

Run Your Own Race

Nigeria is fast becoming a place where, it’s more important for people (women especially) to be popular and LOOK like they have money, when in actual fact, they are struggling behind closed doors, to uphold an image they can’t keep up.

Buying things just so that you can look as though you have as much money as someone else is silly. When Tinuke buys a bag to top Ada’s bag collection, what she doesn’t know is, Ada owns several properties, as well as an investment portfolio worth 80m, so she won’t be ‘soaking garri’ after she buys a designer bag. Sometimes, the grass is actually greener so don’t compare your beginning with someone else’s middle. Instead of competing with her, use her as a point of contact “Baba God, my own go betta’.

If you are caught up in this mentality its important to focus on surrounding yourself with winners. Friends, who genuinely support you in your endeavors (because friendship is not a competition) and mentors who can guide you on your walk to greatness.

Money and Relationships

It is great to be Mrs. somebody but it’s even better to be a force in your own right so you can be a value addition to the right man. Even if your goal in life is to marry a rich man, being financially literate could help you see through the smoke and mirrors ‘before you go enter one chance.’ Some rich men are not necessarily generous (you don’t want to be the woman who can’t top up her phone without asking her husband) or in some cases not necessarily rich because the more you look, the less you see.

There are many instances of women who ‘thought’ they were marrying into wealth or miscalculated because they saw Family money, a Range rover and a Rolex, that are now ladened with the sole responsibility of paying the rent, staff salaries and children’s school fees.

We need to raise a generation of women who are financially literate. So that they are likely to become beacons of hope for survival in times of stife as opposed to cautionary tales of helplessness.