Features

Smart Money with Arese: If I Won a N100m Lottery….

There are two kinds of money problems, not enough money and too much money. When you are broke all you think about is how to make more money but when you have too much money and don’t have a solid plan on how to spend it, you’ll most likely end up broke again. (Ask Michael Carroll, the dustbin guy who won the lottery for £9m in 2002, then ended up a working in a biscuit factory for £6 an hour a few years later).

It’s important to start thinking about a spending plan for unexpected funds, before you get it, because naturally when money hits our accounts there’s this ‘I have money’ now feeling that overcomes us. When the funds are larger than we are used to, it’s easy to get carried away with spending mindlessly because you are subconsciously thinking I have more than I’ve ever had before so I can afford anything I want. So to come up with my spending plan for unexpected funds I like to play a game called if I won the lottery for N100, 000,000 I would? It helps me articulate what I want my money to do in the larger sense.

3 things I would Invest In

A stock portfolio (N40m)

If we are friends, then you know how passionate I am about the growth prospects of the Nigerian stock market. I believe it’s a solid platform to build long- term wealth. In the words of Warren Buffet when it comes to investing in stocks ‘ be fearful when others are greedy and greedy only when others are fearful’. Basically, since people are weary of the Nigerian stock market, it’s a good time to research and invest in good companies that are undervalued.

I do not believe in borrowing money to buy stock, I do not believe that the stock market is a money doubling scheme (which was the motivation for many people’s investments in 2007, when the market was at its peak. That is an easy way to get burnt) but I believe in systematically using money you can afford to forget about to build long-term wealth. i.e money you would have used to go shopping or buy credit for the month, not your money for rent or school fees.

In that spirit I would invest N40m of my virtual money in building a stock portfolio. Reason being, this is a windfall I did not expect and has nothing to do with my day to day living expenses or other investments, so if it lost all its value tomorrow (which is highly unlikely), ‘e no go pain’!

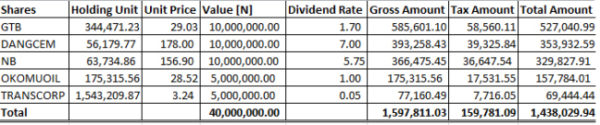

My stock portfolio would look like this. (NB this is a stock portfolio for Arese o, I didn’t send you message, I didn’t say buy this or buy that…this one na example)

GTB, Dangote cement and Nigerian Breweries because I love those bad boys and they never fall my hand! Great liquidity, meaning I can buy and sell at any point no story and they pay regular dividends every year (some years are better than others) Okomu oil because I love the fundamentals behind the business, in this economy where the dollar seems to be king, they earn foreign exchange because they export. In my opinion, their growth prospects are awesome and the agricultural business is the next big thing. Transcorp used to be in my bad books but I think the change in management and the different sectors they are investing in make it a stock to hold long term.

The dividends stated in the table are based on what those companies declared last year and truth be told 2014 was pretty slow, Ebola, political uncertainty and all the negative predictions were bad for business. So N1.5m may not be a phenomenal return but this reflect dividends in a sketchy year and does not take into consideration capital appreciation.

For example, Gtbank had been trading at N18/N19 in December 2014, in April 2015 the day after Buhari was announced the President elect, it soared to N31 because of the positive sentiments that Nigeria was not in fact going to break up as a country. Almost a month later, profit takers have sold their stock to enjoy their profits it has stabilized at N28. Which means if you owned 100,000 units of GTB stock in December it was worth N1.9m today it is worth about N2.8m.

Real estate (N25m)

I would invest in land, in a growth area along Lekki/Epe expressway. A plot facing the road, so it can be used for commercial purposes. (Commercial properties facing a major road tend to appreciate faster than residential properties. For example, if you wanted to buy land in Lekki phase 1. A property on Admiralty road would probably cost around N200m, while residential properties further into the estate cost around N115m. In addition, the rental incomes differ).

I would choose an area like Sangotedo or Ibeju Lekki that is not fully developed in anticipation of the capital appreciation that will ensue when the developments in the surrounding areas are complete i.e Shoprite, the Lekki free trade zone, Dangote refineries, the airport. In 5-10 years those areas will be fully developed and the value would be substantially higher.

Let me put it in perspective, 15 years ago there was no electricity in Lekki phase 1. The people who lived there ran their households solely on generators, people were generally skeptical of the fact that the area was sand filled, ‘Lekki is too far’ they said and if someone owed you money and promised to give you their land in Lekki phase 1, you would probably look at them cross eyed and tell them to get serious. However, 15 years down the line the story has changed property prices in the area are now in the hundreds of millions.

Back to what I would do with this land I’ve bought for N15m. (hopefully it’s so expensive because, the papers have already been perfected and I can ensure minimal dealings with Omonile ) While I’m waiting for the land to appreciate in value, by which time I hope that banks, filling stations, Dominos and the like can come and offer me 100s of millions for it, I will spend N10m ( using local contractors) building a shopping complex. Nothing fancy just 10 shops. Each with an estimated rental income of N600k per annum x 10 units = N6million per annum, which means a 24% return on my N25m investment per annum. Hopefully in 5 years, I would have recouped my capital.

A small business (N20m)

I would invest N20m in a small business under the following conditions.

- A business model I believe in (profitable), in an industry I understand.

- Management/ founders I can trust to execute better than they have planned.

- An exit strategy. My capital can be termed a convertible debt. I will offer lower interest rates than the banks i.e. 17%. The interest must be paid every 90 days. We can rollover the principal for 5 years, if the founders have been able to repay interest consistently (this could be an indication that the business is profitable and the owners are honest) the debt can be converted to Equity, at which point we can negotiate a percentage of the profits as my return.

3 Things I Would Splurge On

If you ask 10 Naija people to name ten things they would spend their money on outside of investing, the lists would probably look similar. However, if you asked each person to prioritize their top 3 things, not the things they felt made them ‘look financially successful’ but the things that would make them truly happy, I guarantee you their lists will be different. In short, what I like and what my BFF Nnenna likes are different.

These are the 3 things that’ll make my heart sing!

I’m obsessed with holidays. They are my escape from the hassles of day-to-day life and in my experience they last forever. Once a holiday is booked and paid for. I’m automatically in beast mode; it will ginger me to work harder than ever, just so I can feel like I deserve it.

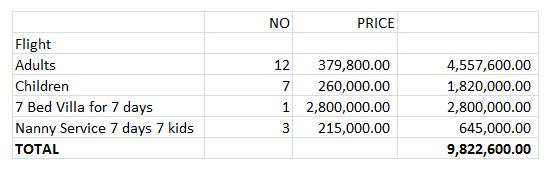

I would book a package deal with @africholidays on a girls holiday to Spain with my sisters, my best friends and their children. This is what it would look like. (me, Zikora, Isoken, Ivie, Nnenna, Zara, Zida +Zach, Nadine +Omari, Mariah,Toke, Wonu+Konam+Zane, Amaka+Micah, Isedua+Adesuwa, Nini, Eniola,Yvonne,Lilian+Ada). This would be such an Epic holiday with some of the best people in my life…. Obviously I had the best time planning this fictitious holiday. It involved 15 adults and 9 children.

A Chanel Bag

Yes I LOVE Chanel…it is my guilty pleasure! Chanel classics are the truth! They last forever and they never go out of style…it is an investment piece (I do not believe in expensive seasonal accessories unless they are a gift)

I could be a hypocrite and say if I won the lottery I would *insert some goody too shoes purchase* but being smart with my money is not about extreme frugality but about using money as a tool to build the life I desire which means finding a balance between my guilty pleasures and building assets.

Redecorate My Daughter’s Room – Complete with a New Wardrobe

Her room would look like this:

And her wardrobe would be filled with pieces from African children’s wear designers.

See what I did there. I improved my net worth by N85m by purchasing assets that would provide me with an income and most likely appreciate over time. I still spent on ‘seemingly’ extravagant things. I had fun with my money but secured my financial future. Being smart with your money is not about extreme frugality but about building wealth that buys you options.

Back to reality!

The whole point of this exercise is to encourage a wealthy mindset, invest first, and spend later. Even though the odds of winning the lottery are low, start adopting this with all the bonuses and any extras you get. Invest towards improving your net worth FIRST then spend on the things you love.

The truth is no matter how abundant your resources seem, you have to spend money in a way that makes sure that your money is making more money. For example, If Emeka makes a N100 million Naira and spends N100 million Naira, on non- assets (i.e rent in Ikoyi, (N20m, Range rover N40m, shopping spree N10m, luxury holiday (20m) miscellaneous N10m) what he has left is zero. Therefore he was a millionaire for a minute but he is no longer a millionaire. He is ‘hood rich’ not wealthy.

Lets continue the conversation… if you won the lottery for N100m… how would you spend it? #spendN100m

Photo Credit: Mr and Mrs Smith | Chanel | Petittribe.com | BeauBelleAfrica.com | Raguke