Features

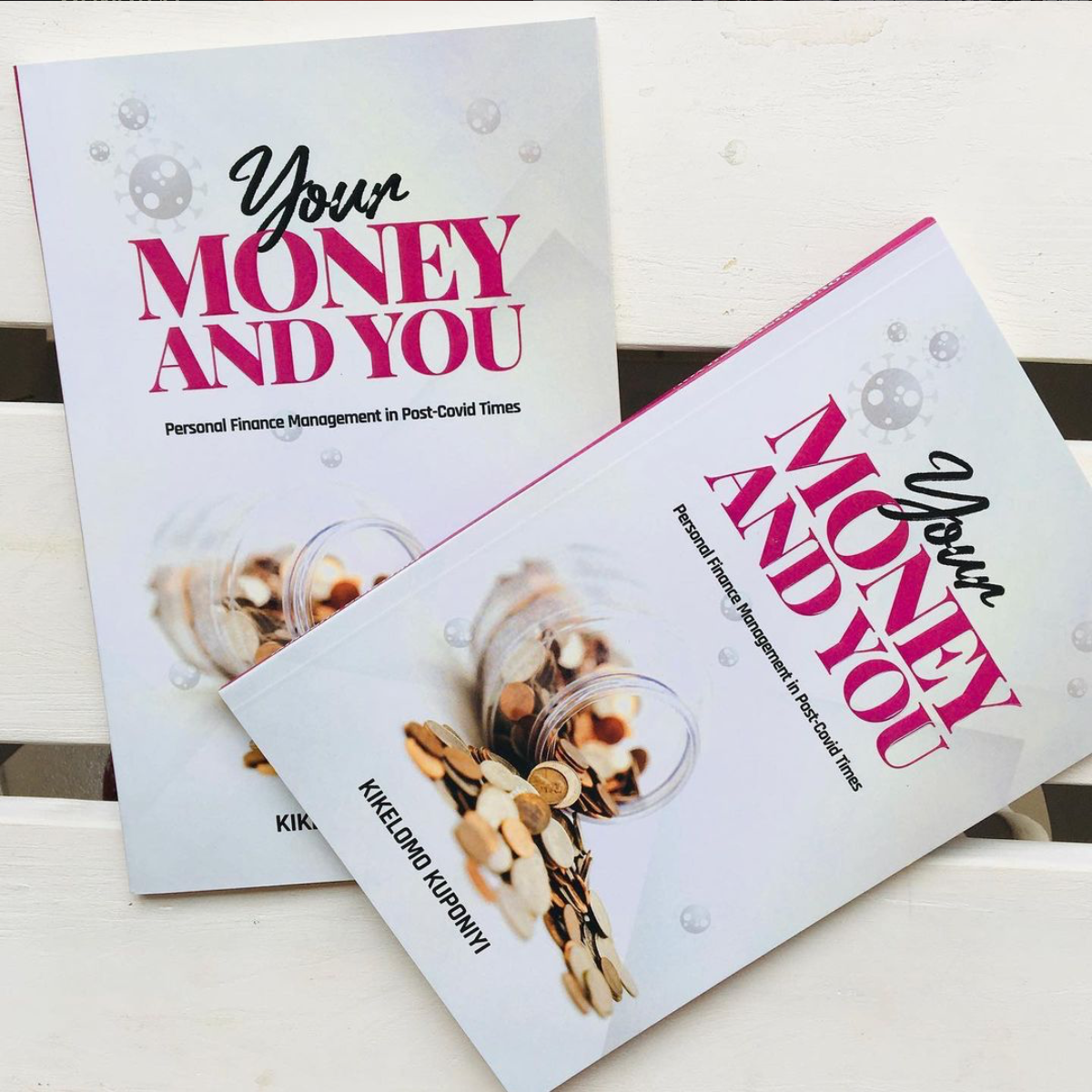

BN Book Review: Your Money and You by Kikelomo Kuponiyi | Review by The BookLady NG

Many people will agree that it is easier to spend than to save, especially during these perilous times of sapa. Saving requires diligence, consistency and sometimes sheer doggedness to see it through. Don’t add doggedness and you’ll find yourself breaking that kolo or piggy bank or, in fact, withdrawing your money from the bank if you didn’t put a time frame on it. For many of us, spending is almost instinctive. It doesn’t matter your vantage point. Kikelomo Kuponiyi has written Your Money and You to help you navigate your choices accordingly.

Getting right into the book would find you following the story of Nike, a banker, who has managed to immerse herself in debts. Creditors are beating down on her door so much that it gradually escalates into a messy situation. The downside is that this has become the story of most people, especially during this post-COVID times. There are so many things to buy, so many things to do, so many needs to meet and the economic downturn has not helped in getting any closer to achieving these things. It is a sore sight what the naira has become at N600 to $1. In fact, going by the decline, ‘today you’re cruising in a Mercedes, tomorrow you’re hawking roast groundnuts,’ in Jennifer Makumbi’s words. For that not to be your reality and to generally make wise money decisions, Your Money and You offers the much-needed clarity.

Going further into the book will broaden your knowledge of how money works. There are so many ways to make your money work for you and they are all enumerated in this book. Sometimes, you might be wondering why some things are not adding up, for example, how five to 10 days into a new month after getting paid, you are left with just five thousand naira, no matter how hard you try to be prudent.

Have you perhaps considered that you might be missing one detail and that could be a piece of information laying somewhere on the pages of this book? You might have been strategising and planning your money game, but then you feel like you are missing something. That something is right here under your nose and it is only a matter of picking a book like Your Money and You to uncover the missing puzzle. Financial literacy is an inexhaustible subject matter that cannot be overemphasised. Therefore, we need books like this that provide refreshing and simple information about money to keep us abreast.

Kikelomo shares important information on savings, investments, loans, budgeting, giving, and so on. You could be a saver. You could be an investor. You could be both. Saving will require you to put away part of your earnings, while investing will require you to take a risk with part or some of your savings. Also, do you know what is better than taking a loan? Paying back the loan. Kikelomo expounds on loans in the fourth chapter of the book, taking us through the dos and the don’ts of collecting loans. According to her, ‘We tend to use loans to bridge gaps arising from insufficient savings or investments. We use loans to do what savings or investments should do for us. This is not bad in itself. Loans can be beneficial if properly used. But many people have found themselves in a financial mess due to unmanageable loans.’ She also enunciates on budgeting and how ‘it is a financial planning tool that allows you to allocate funds for specific purposes.’ She includes a chapter on giving as well. Well, life is a circle of giving and receiving and as such it is essential to give as much, if not more than we receive.

Your Money and You is one of those books that can serve as a referential material for any information on how to make your money work for you and not walk away from you. It is a concise material that approaches money matter with precision. If you don’t read books on finances owing to the many financial jargons you might find there, this book is a welcome relief for you. It explores cogent topics on money with very simple language and accuracy that would have you flipping the pages swiftly. Each chapter ends with a short summary that aids understanding. It used to be ‘ignorance is bliss’, now it is ‘ignorance is no defense.’ I believe there is no better ammunition than knowledge in matters that concerns growing your money and working towards your financial freedom.