News

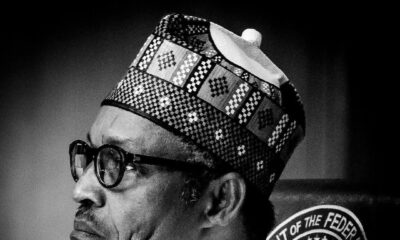

Femi Pedro: Buhari and the Solution to the Nigerian Currency Quagmire

Our nation is currently submerged in a currency crisis. The value of our national currency is tumbling against the dollar on a daily basis, and our foreign exchange reserves continue to dwindle as a result of the continuous fall in the price of crude oil. In recent months, there has been a rigorous debate as to whether the devaluation of our currency is the answer to these problems, and what specific measures need to be put in place to stabilize our currency and prevent further damage to our fragile economy. As the debate rages on, the damage to the naira, the economy, and the psyche of our people has intensified. The Central Bank of Nigeria (CBN) appears to have lost significant control of the situation, and speculators, currency traffickers and perpetrators of arbitrage have seized the initiative in the parallel market.

It is fair to say that under President Muhammadu Buhari’s tenure, the Nigerian Financial Sector has endured its reasonable share of activity and critical scrutiny. Three major incidents have stood out, and these incidents are intertwined in terms of the collective impact they have all had on the sustained call to devalue the Naira. First, in the past year alone (dating back to the previous administration), the Central Bank of Nigeria (CBN) has reeled out a series of policy reforms on the foreign exchange market that has sent panic to the market. Leading up to the general elections conducted last year, the market began to experience a significant shortage of dollars. This dwindling of our reserves was caused by falling oil prices, while the huge demand was fuelled by election spending and the accompanying market nervousness in the aftermath of the change of government. Secondly, the Federal Government issued a directive on the consolidation of Government revenues into a single treasury account (TSA), a bold policy currently being implemented at its infancy stages by the CBN. The immediate effect of this policy has been the estimated movement of over N2 trillion from private banks to the CBN, which has dipped liquidity and spiked interbank and other interest rates. Thirdly, and probably as a result of the first two points, we received the curious news sometime in 2015 that JP Morgan

Chase-an American-based International Financial Service Firm- would be delisting Nigeria from its Government Bond Index for Emerging Markets (GBI-EM) in what they called “a phased-out process” between September and October this year. JP Morgan cited a lack of transparency and liquidity in our foreign exchange market as the primary reason for its decision. The significance of this announcement cannot be understated, because JP Morgan Chase provides the pricing and trading platform for foreign investors who hold or are planning to hold Nigerian Government-issued bonds, and they also create and sustain an active market for these bonds.

The impact of these incidents collectively has resulted in a panic sell-off at the Nigerian Stock Exchange (NSE) by foreign investors in the market. The NSE market capitalization of listed equities instantly lost about N311 billion or 2.98%. In addition, the announcement threatened the stability of the Nigerian Bond market and the ability of the Government to use the market to raise funds in the near future. The CBN was forced into damage-control by issuing a public statement to the effect that it disagrees with the expulsion, and denied the claim of a lack of transparency and liquidity in the market. Some industry analysts have joined in supporting the CBN’s statement, while downplaying the possible negative effects on foreign investment and the Nigerian economy.

You see, JP Morgan’s argument has been fairly straightforward: “We know the level of your reserve and we know it is dwindling. We know why you have been tinkering with your foreign exchange policy in recent times: because you are protecting your naira and keeping the value low. We know that your currency is overvalued and underpriced. So, release your hold on pricing mechanisms and let the forces of ‘demand and supply’ determine price”. Of course, JP Morgan’s primary interest is the protection of its clients- the foreign investors playing in the bond market- because that is its main responsibility.

These major action points, alongside some of the uncertainties that have arisen as the Federal Government grapples with how to articulate its holistic fiscal policy and medium-term Economic framework, have created deep-rooted cracks on the naira exchange rate. The cumulative effect has been the sustained pressure (both locally and internationally) carefully mounted on the CBN to devalue the naira to reflect its ‘true’ value at the parallel market. The pressure is on the government to remove its hold on the official rate by moving the rate closer to the parallel market rate, with the expectation that a higher official rate would price the scarce foreign exchange appropriately and attract players back to the official market, thereby improving supply and increasing market stability. If historical antecedents are anything to go by, this devaluation proposition is unlikely to have the desired effect.

Those who fail to learn from history are doomed to repeat it, so in our attempt to adopting bold, decisive and creative solutions to stop the economic bleeding, we must properly educate ourselves on our current situation, and how we got here in the first place. It is a situation that has played itself out in countries like Brazil, Argentina, Greece and Venezuela. Some of these countries survived their currency quagmire by taking bold, decisive and creative steps to limit the damage to their economy and return their currency back to normalcy. In actual fact, this is not a situation that is completely unfamiliar to us.

The rapid evolution of the Nigerian foreign exchange market began in 1982, when comprehensive foreign exchange controls were enacted to manage the monetary crises that ensued that year. We subsequently moved to the era of Second-tier Foreign Exchange Market (SFEM), introduced in 1986 to manage the fall-out of the exchange control system introduced in 1982. Further liberalization reform measures were introduced by the introduction of the Bureau-De-Change (BDC) market to improve access to foreign exchange by small and retail users. This particular measure, without clear guidelines and monitoring systems, pushed the parallel market to the forefront with full force. The resultant volatility caused by the flourishing parallel market led to the introduction of further reforms by way of the Foreign Exchange Market in 1994. These new reforms included the formal pegging of the naira exchange rate, the centralization of the market at the CBN, the restriction of the operations of BDCs, and the discontinuation of the Open Accounts and Bills for Collection System as a means of payment. Further measures were implemented in 1995, with the introduction of the Autonomous Foreign Exchange Market (AFEM) when, for the first time, the market was liberalized with end-users able to buy and sell foreign exchange from CBN through banks at market determined rates. By 1999, we began to witness a further liberalization of the market by the introduction of the Inter-bank Foreign Exchange Market (IFEM).

The current foreign exchange regime is an off-shoot of the last major reforms between 1995 and 1999. The supply of foreign exchange has been dwindling since the price of crude oil started its free-fall in 2015, whilst foreign exchange demand has been on the rise due to market confusion, its negative perception of future supply, recent CBN measures to manage demand and an overall loss of confidence in the market by foreign investors and speculative dealers in foreign exchange. Indeed, the structural impediments or the 90s are still intact today. Rather than removing the bureaucratic bottlenecks in the system, successive CBN administrations have been focusing on defending the naira by tinkering with the pricing mechanism, while letting illegal operators take the initiative. The result of this is the existence of a two-tier market: the legal (official) market, and the illegal (parallel) market.

The official market comprises of the CBN as the main supplier, and banks, oil companies, non-oil exporters, Bureau de Change (BDC) licensed operators and legitimate end-users who deal in the inter-bank and autonomous trading window within the banking system. The CBN has kept a lid on the rate in this market at around 199 naira to the dollar. This is the only legal foreign exchange market supported by existing laws. On the other hand, the parallel market comprises of a collection of players including speculators, currency traders, street currency hawkers, tourists, travellers, traders, small and medium-sized businesses (SMEs) and migrants from the official market attracted by the huge differentials in the rates for arbitrage opportunities, and the ease and simplicity of the market. The problem has been further compounded by the CBN’s conscious and deliberate position to ignore the parallel market’s existence by pretending that there is only one exchange rate. Its stubbornness has driven buyers and sellers to the parallel market, making the official market more unstable.

Of course, the primary objective has always been the efficient management of the foreign exchange market by determining the true price of foreign currency vis-a-vis the naira. The reality is that nobody- including the CBN- knows the true value of the naira. The value of a currency is its price, just like price determines the value of goods and services. The Naira-Dollar ‘product’ is like any other good; its price is determined by a complex interplay of demand and supply, which forms the price at equilibrium. The real quagmire is this: who knows the actual demand and supply? Of course, the CBN knows how much dollars are available for sale on a weekly basis, and how much naira is utilized to meet the demand for the dollar. The information that the CBN possesses comes from its position as the major supplier of both currencies, and its main function as the banker to our banks and the custodian of the foreign exchange market. In truth however, nobody has the authentic information on the actual volumes of Naira and Dollars chasing each other in our economy.

To make matters more complicated, this is only a segment of the market. For example, the official exchange rate is pegged at approximately N199 to $1 because it is based on CBN’s information on the official demand and supply, which is supposed to be the equilibrium price. Unfortunately, the mechanism for arriving at this rate is largely discretionary and unscientific. The CBN may have been right in arriving at this rate, but it very well may have been wrong in arriving at this rate as well. The parallel market rate is hovering around N400-$1 today because the market gets some of its supply from the CBN and will naturally add profit to resell. It is selling mostly cash, which always sells at a premium. Cash has a monopoly because the traders in this market have perfected the art of rigging rates. All these aggregately ensure that the parallel market rates will forever be ahead of the official rates. It is wrong to use the parallel market rate as a reference point because it is not determined by any traceable interplay of demand and supply. The rate is rigged and illegal, and should be ignored in its entirety.

Indeed, it is not a surprise that the parallel market is probably bigger and more active than the official CBN market. Nobody knows the exact volume of dollars being traded in this unofficial market, or the naira-cash floating outside the banking system that is being used to buy and sell dollars. We do not have accurate estimates on the number of mallams, or the total volume being traded by them daily. We do not know the exact volume being traded by unregistered foreign exchange dealers all over the country. We also do not know the exact amount of raw cash dollars imported and exported by Nigerians and foreigners. So, how then can you determine the equilibrium price of a market with so many unknowns!

President Buhari is correct in believing that our currency does not need to be devalued – for the time being. For example, no amount of devaluation will bring up the price of oil. Devaluation will not eliminate parallel market players, nor will it necessarily increase the supply of dollars into the market. In actual fact, devaluation will simply push the official rate (and by extension, the parallel rate) up, thereby compounding the currency crisis and further driving more players to the parallel market. Inflation will rise, impacting the cost of essential products and services within our economy.

The sum-total of the aforementioned points is that it is unhelpful to conclude that our naira should be devalued, because we simply do not have any rational indices for measuring the naira’s true value. A further devaluation will devastate our economy because it will technically make our imports more expensive and our exports cheaper. This is somewhat unhelpful to us because we import practically everything and export very little except oil, whose price is determined internationally and whose supply is quota-based. Therefore, the gains of devaluation would be inapplicable to our situation, while the adverse effects- higher import prices, higher rate of inflation, more pressure on the demand for dollar, higher unemployment and general recession- would be catastrophic to us.

Perhaps, a silver lining in all of this can be adduced from our recent experience with petroleum importation, pricing and marketing. The introduction of the subsidy regime by the Obasanjo administration around 2005- whilst commendable in its intent to maintain a low pump price on our imported petroleum products- turned out to be a catastrophic and costly error on the part of the previous administrations that retained it. The subsidy-era was marred by market instability, regular fuel shortages, a thriving black market for fuel and huge debts allegedly owed to importers. Now that the subsidy regime is virtually non-existent, the market has gradually become stable, and many of the associated problems have disappeared. First, there is only one recognized market price (at the filling stations) across the country. Secondly, there no longer exists a thriving parallel market for petrol; there simply is no need for one, as there is no scarcity or bottleneck in the supply chain for now. Thirdly, suppliers are motivated to supply because the pump price has been determined by factoring all possible costs and profit margin from point of purchase to point of sale. In addition, this system will always adjust the pump price mechanically, thereby guaranteeing regular supply at all times. The end result is that consumers are invariably assured that supply will be regular and price will continue to be market-determined. There is no guarantee that this current solution will be permanent, but it is at least a marked improvement from the previous uncertainty. A replication of this way of thinking by the CBN will go a long way towards returning normalcy to our currency market.

What then is the way forward with our currency? First, the Federal Government has to fast-track its efforts towards implementing a sustainable fiscal policy regime tailored towards boosting our local industry. Curbing corruption, promoting import substitution and the exportation of indigenous products will go a long way in achieving this aim. Countries like India, South Africa, Malaysia, Indonesia and Egypt have little or no oil dollars, but all have more stable currencies and stronger liquidity than we currently do. They have been able to successfully tap into these “other sources” and develop a stable foreign exchange system with a thriving market to boost supply and manage demand.

Secondly, a critical solution lies in our ability to bring sanity to our foreign exchange system and have better controls over the demand and supply mechanism. As a matter of national emergency, the parallel market has to be destroyed. The Foreign Exchange (Monitoring & Miscellaneous Provisions) act of 1995 as amended, the Money Laundering (Prohibition) Act of 2011 and other Laws of the Federation are some of the legal tools available to enforce the collapse of the parallel market.

The CBN has to overhaul the foreign exchange regime by bringing all legitimate buyers and sellers into the official market. For example, the use of credit cards to make purchases online and in foreign currencies should be re-introduced, with each authorized dealer setting its own limit depending on capacity. The way to do this is to simplify the buying and selling process by making documentation easy and seamless, and accommodate all economic users of foreign exchange. The buying and selling process could be simplified through the authorized dealers with clear and unambiguous rules, while CBN provides adequate supply to the market at all times.

Finally, and perhaps most crucially, the CBN must create a buyer surcharge and seller premium system. Under this system, buyers of foreign exchange for products and services categorised as essential or critical to the economy would be sold foreign exchange at the official buying rate. Rather than impose restrictions and/or bans on other users of foreign exchange outside the essential list, the foreign exchange could be sold to non-essential categories at the same official buying rate (a single exchange rate system) but with an additional fixed surcharge imposed for accessing foreign exchange. This will be paid upfront at the point of purchase to the coffers of government. It can be categorized as a special tax for users of foreign exchange for purposes considered as non-essential or non-contributory to the progress of the economy. This special tax becomes a premium to government. It will be an immediate boost to the national revenue, and the Government may choose to utilize this fund to promote and boost the non-oil export sector. It will also make these products and services more expensive, and possibly have the long term effect of discouraging the importation of non-essential items.

Simultaneously, suppliers of foreign exchange to the market can be incentivized into selling at the official selling rate, while also earning an “incentive premium”. It should be noted that the CBN is not the only supplier to the market. Other suppliers include oil firms, exporting firms, Nigerians in diaspora, foreign investors, foreign lenders, etc. These suppliers could provide a much higher volume to the market than the CBN if motivated and encouraged. For example, an incentive premium of 10% could be paid from the surcharge proceeds to encourage and motivate suppliers to bring their foreign exchange to the official market. This system of surcharge and premium could be sustained until the market stabilizes. The CBN would simply midwife the process by maintaining and aggregating adequate supply into the market as much as possible. It would also be responsible for posting the official daily buying and selling rates based on market fundamentals, managing the surcharge and premium regime, and determining the categorization of essential users on a periodic basis. It should also put in place a regular audit and monitoring process to ensure strict compliance and adherence.

The immediate effect of effectively implementing the above recommendations will be a single official foreign exchange market with all players (buyers, sellers, dealers, government) adhering to the same set of rules and regulations. The parallel market would die a natural death, and there will be an efficient pricing mechanism with a single exchange rate. This in turn will lead to an effective and efficient management of our foreign exchange reserves, and will enhance the attraction of foreign exchange into the system from other sources. Putting the tax and incentive mechanism in place will have the combined effect of encouraging supply and penalizing the frivolous use of our scarce foreign exchange. This also creates a new source of revenue for the Government, and acts as a check on those who would normally cheat on import-duty payments. The economic impact will be appreciation or depreciation, but not a devaluation of the value of the naira. There will be market and price stability, gradual confidence restored back to the single market and demand and supply equilibrium.

It would become easier for the Federal Government to deploy its security apparatus and other legal instruments towards chasing away the remnant players in the illegal market when the CBN successfully brings the legal buyers and sellers into the official market. With regards to the parallel market operators, the Government should apply the same vigor that it is adopting in its pursuit of corrupt officials, because every effort to manage our foreign exchange market will simply be like pouring water into a woven basket until the parallel market is eliminated or reduced to insignificance.

Any attempt to devalue the currency for the time being would amount to treating an ailment without a proper diagnosis. In fact, many of these issues have been with us for over 35 years. They are not going away until we take a firm stance towards rendering the underground foreign exchange market insignificant and irrelevant. This will allow us to focus on addressing the actual value of our currency against the dollar and other currencies.

____________________________________________________________________

Otunba Femi Pedro is a Banker and an Economist. He is a former Deputy Governor of Lagos State, and the former Managing Director of First Atlantic Bank (FinBank) Plc. He can be reached via the Twitter Handle: @femipedro