News

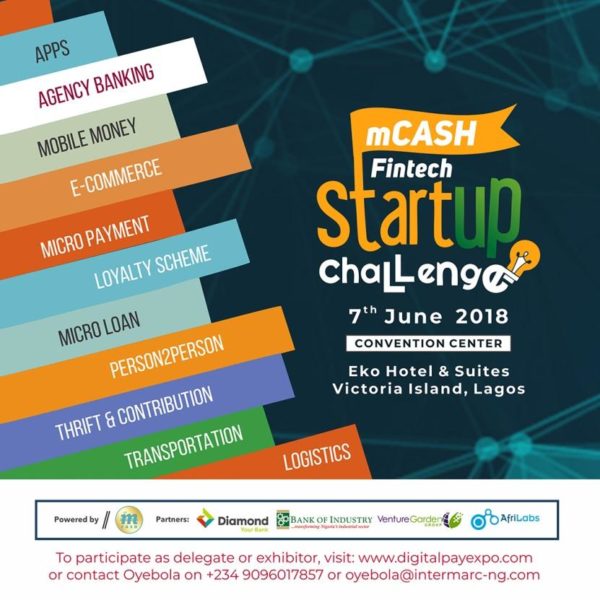

Want to take your Start-up to the Next Level? Enter the mCash Fintech Startup Challenge to get N1m in Funding

The annual mCash Prize for innovation in Fintech is instituted by the Nigeria Interbank Settlement System (NIBSS) to encourage a creative approach to advancing payment solutions with the understanding that payment is the main driver of economic activities. This year our adventure is taking us to the financial inclusion market to explore the solutions that will accelerate the onboarding process for the unbanked population of Africa.

The annual mCash Prize for innovation in Fintech is instituted by the Nigeria Interbank Settlement System (NIBSS) to encourage a creative approach to advancing payment solutions with the understanding that payment is the main driver of economic activities. This year our adventure is taking us to the financial inclusion market to explore the solutions that will accelerate the onboarding process for the unbanked population of Africa.

Although the need for financial inclusion is well understood, the solution has proved elusive. The barriers to inclusivity in Africa are usually formidable. Access to education, communications services, financial and banking services pose special challenges, especially in Africa. The barriers include distance from a financial service provider, lack of necessary documentation papers and lack of trust in financial service providers.

In 2018, we are committed to launch and administer the mCash Fintech Start-Up Challenge to Build Financial Inclusion, a challenge that will offer cash prizes and recognition to individuals, teams of individuals, corporations, and nonprofit organizations with the best mobile applications (apps) that help Nigerians make smart financial choices and beer access financial services. The goal of the challenge is to motivate and to develop an ecosystem of local innovators, software developers, the public, and students to foster continued innovation and a greater volume of high-quality, next-generation mobile tool s to help underserved consumers control and shape their financial futures.

Start-up challenge goals:

- To motivate and develop an ecosystem of local innovators, software developers, the public, and students to foster continued innovation and a greater volume of high-quality, next-generation mobile tools to help underserved consumers control and shape their financial futures.

- To identify and support digital innovation destined to accelerate enterprise development across Nigeria

- To learn about new development on the fringes of payment industry.

Application details:

The challenge is open to a wide spectrum of financial inclusion startups demonstrating innovation and potential for impact, financial sustainability, and scalability for the unbanked market in Nigeria.

While some progress has been made through new technologies such as mobile money, we are on the lookout for break-through payments solution that has the potential to displace cash and profoundly change the financial situation of the unbanked and financially excluded. To do this, the solution needs to meet three key criteria:

- It should be affordable: inexpensive to deploy and use, even for the smallest transactions.

- It should be versatile: suitable for use both by traders and all segments of the general public.

- It should be simple: accessible to users with low financial literacy.

Basic Eligibility:

- The start-up must help advance financial inclusion.

- The start-up must be technology-based and innovative in concept

- The start-up solution should have gained early traction or developed an MVP

If selected as winners, ventures must have a founder or co-founder committed to attend Incubation and Entrepreneurship Development Program in the last quarter of 2018.

Judging Criteria:

- Start-Ups will be assessed on the originality of their approach to solving a financial inclusion challenge using micro-payment

- Start-Ups will be evaluated on their ability to impact lives through four metrics:

Access to financial services, Local job creation, Revenue generation for investors and Unique User Experience Design for the target audience.

Prize:

There is prize money of N1, 000, 000. 00 (One Million Naira each) for top three winners

How to apply:

Interested start-ups should register at http://digitalpayexpo.com/mcashchallenge/

All entries will be reviewed by the Selection Board who consists of carefully selected accomplished professionals and venture capitalists in the payment industry.

—————————————————————————————————————————————————————————————–

Sponsored Content