News

A 171.32Billion Naira Loss…This Financial Analysts’ report on Oando has Everyone Talking

The global crash of oil prices has had a devastating effect on the Nigerian economy. Major oil players are suffering the consequences and the FY2014 report and Q12015 released by Oando today has got everyone talking.

The global crash of oil prices has had a devastating effect on the Nigerian economy. Major oil players are suffering the consequences and the FY2014 report and Q12015 released by Oando today has got everyone talking.

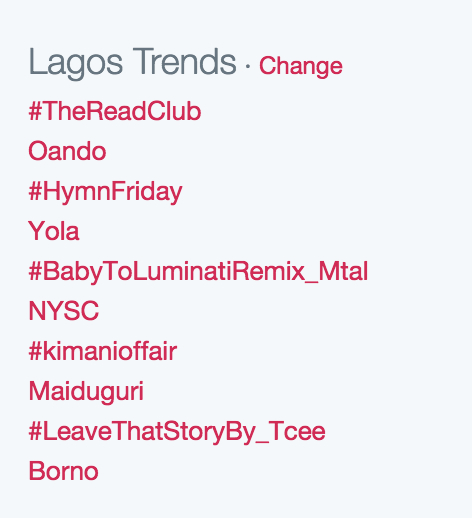

Oando is currently No 2 on the Lagos Trends list on Twitter.

The company reported a 171.32Billion Naira Loss in 2014. Other intriguing numbers include 271billion Naira in administrative expenses.

This TV report by BTVA is racking up hits as they analyze Oando, Mobil and Forte’s numbers.