News

Godwin Emefiele Dismisses Report that CBN is Planning to prosecute Nigerians keeping dollars at home

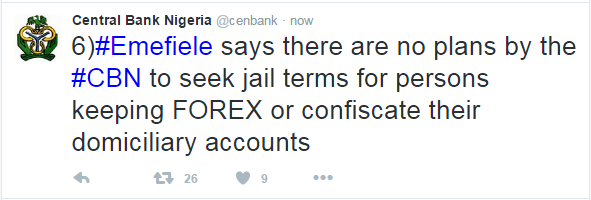

The Central Bank of Nigeria (CBN) Governor, Godwin Emefiele, said the allegation by some members of the public that the bank planned jail term for Nigerians keeping dollars at home was untrue.

The Central Bank of Nigeria (CBN) Governor, Godwin Emefiele, said the allegation by some members of the public that the bank planned jail term for Nigerians keeping dollars at home was untrue.

He said this in Abuja on Tuesday during a news conference, adding that there was nothing in the nation’s current foreign exchange regulations suggesting that people would be jailed or that their dollars would be confiscated.

He, however, said that he was aware that the Nigerian Law Reforms Commission (NLRC) was looking at reviewing the foreign exchange regulations as a routine duty.

“The NLRC is an agency of government that has the responsibility of reviewing all laws in the country from time to time depending on exigencies of time,’’ he said.

He also said that the CBN had not been contacted regarding some of the clauses included in the review being conducted by the NLRC.

“I am saying here and categorically that if we are contacted or whenever it becomes an issue for discussion, we would suggest and advise against a clause that forbids people from keeping their dollars if they choose to or a law that says people should be jailed for keeping foreign currency.

Again, there is nothing in our current and extant foreign currency laws and regulations that says that people will be jailed or that their foreign currencies will be confiscated.

I advise people to please stop listening to rumour mongers,’’ he said.

Addressing the issue of risks faced by Nigerian banks in a challenging economy, Emefiele reassured that Nigerian banks were facing the same risks all other banks in other climes were facing presently due to the global economic challenge.

“Normally in any economy, when there is a slow down or there is even a recession, naturally financial institutions, particularly banks, will face certain risks.

That imposes on the regulator a great challenge to ensure that he strengthens his guidelines to ensure that the banks and particularly depositors are protected.

Nigerian banks like other banks in other climes are facing risks but those risks are surmountable.

The CBN is doing its best to make sure that those risks do not crystallise to a point where we begin to talk of depositors risking their deposits,’’ Emefeile said.

On the apex bank’s role in stimulating the economy, the governor said that the CBN was still putting in place measures meant to intervene.

He said the CBN was involved in various forms of intervention in line with the enabling act that allows it to conduct development finance activities.

He said all the intervention programmes the bank had embarked on were meant to channel funds at low interest rates to sectors that the CBN felt needed priority attention to benefit the economy.

He, however, explained that there was accelerated growth in the agriculture sector and that it would encourage the CBN to continue to do more to increase agricultural productivity and output.

This, he said, would ultimately lead to moderation in prices of agricultural produce.