Promotions

Prepare to Experience Seamless & Reliable Banking with Digital Bank, gomoney

gomoney, a digital bank designed to simplify money for everyone is changing the face of banking as we know it.

The bank gives its users an all-in-one experience that includes everything you’d get from a conventional bank account, with the addition of tools to help you better understand and organize your spending.

In an effort to provide seamless, reliable banking services without the cumbersome back-office operations and mostly unnecessary physical touch-points, gomoney has opted for a fully digital experience. Their goal, they emphasize, is to contribute towards a future where every Nigerian gets the stress-free quality banking they deserve.

Their keenness for inclusive and accessible banking is especially reflected in their account tiers which allows users to open and operate accounts without having to provide all of their information at once. This is to reduce the barrier for entry, as a lot of people don’t always have the required documents to operate a full bank account in the traditional sense. Accounts can be upgraded along the tiers by providing additional information as required by the CBN.

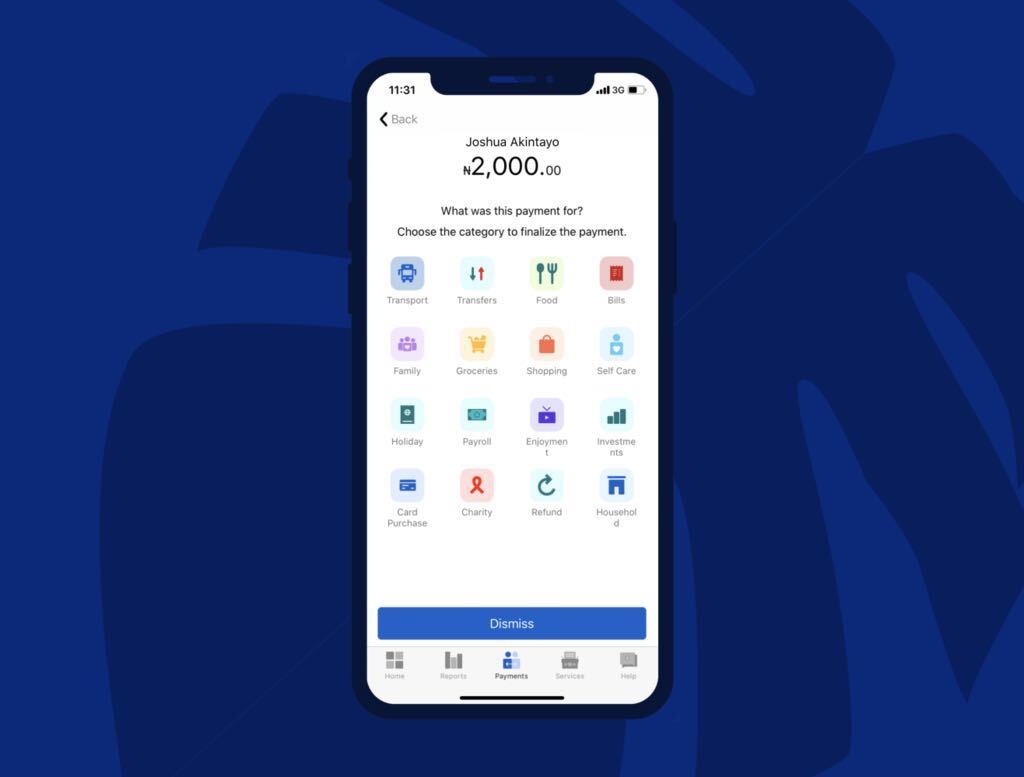

Regardless of the tier a customer belongs to, they are able to enjoy an array of tools geared towards simplifying and enhancing their banking experience. Driven by the mission to “simplify money for everyone”, the gomoney team has designed a platform that provides customers with meaningful transaction reports and an ability to categorize every transaction for easier tracking towards understanding their spending habits and making better financial decisions.

It’s a platform where you can see how much you’re spending on Uber or data purchase on a month on month basis. They even let you know when you’re spending more than you earn so you know you need to start watching your expenses. Your statements are automatically generated every month and stored for you.

Payments with gomoney are intuitive and fun. If you’ve thought about being able to send money in a particular way, the gomoney app probably has a feature for it. You can schedule one-time payments or set up recurring payments, you can split new or existing transactions and bills with friends, send payment requests and pay every bill you have within the app.

With a virtual Mastercard, you have everything you need to pay your subscriptions and make purchases online in a safe and secure way. Netflix and Jumia food are covered so you can enjoy working from home without a hassle.

Last week, in an effort to highlight their preference for community banking, the gomoney team launched a referral program where customers can earn rewards for bringing their friends and family on board. When a referred user successfully opens a tier-2 gomoney account and completes a transaction of at least NGN 2000 on either a bill purchase or through the use of their virtual card, the referrer and the referred earns N300 and N200 respectively.

Both users must verify their BVN on their gomoney account to qualify.

gomoney is available on both Android and iOS, and once downloaded, users can open an operational account in 3 minutes or less. It’s not the bank you need, it’s the bank you deserve. You work hard, let gomoney simplify money for you.

Find out more about gomoney on here

________________________________________________________________________________

Sponsored Content