Promotions

While you “Detty” this December, FundBae is offering you easy Means of Saving towards Financial Wellness

It’s that time of the year again! While different quarters continue to argue about whether or not to ‘Detty’ this December and by how much, we can all agree that 2020 needs to end quickly.

That said, before we ring in the New Year and hope for better times ahead, it’s ever so important that we exercise the right amount of control over our money.

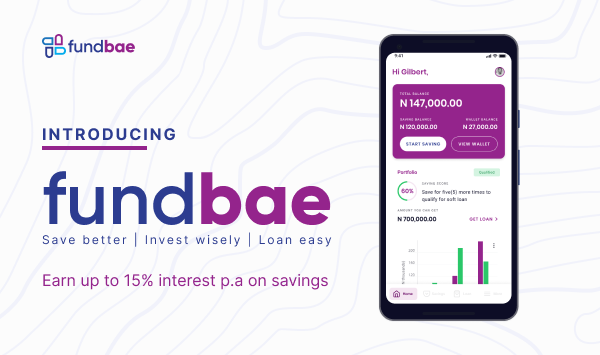

We do know that personal finance doesn’t come naturally to everyone. That’s why you are being introduced to Fundbae, an application that allows you to keep your finances under control.

Fundbae is a financial service platform that enables you to spend, save, and invest in one harmonious app with any amount of money at your preferred pace.

With Fundbae, you can get an interest on savings up to 15%, when you subscribe to any of the following products:

- Flexbae – a flexible savings account you earn interest on your loose funds in as little as 24 hours. The interest rate is up to 12% per annum.

- Vault Lite – a plan that enables you to save consistently towards a particular financial goal. The interest rate for your vault account is up to 10% per annum.

- Vault Plus – a fixed savings option that allows you to earn higher interest per annum. The interest rate on your vault plus is up to 15% per annum and paid upfront.

- Save2B – a savings plan where you earn a high-interest rate and qualify for a loan of up to 200% of your savings after consistent savings for six months.

Given the current financial crisis, Fundbae provides a platform for you to make wise decisions with your money and create a nest egg for yourself. The fact that you can start with any amount you have today ensures that you can start on the journey of financial responsibility instantly.

Here are some simple steps to get you started on Fundbae:

- Log on to the website www.fundbae.ng, or download the Fundbae App on Play Store to create an account.

- Set up your withdrawal account details – this is the bank where your funds are sent to when you choose to withdraw.

- Provide your debit card details to activate your FlexBae account, then make your first deposit (you can use a MasterCard, Visa, or Verve card from any Nigerian bank).

- You can then opt for any savings plans and begin to save at your preferred pace.

You may have been told that the best time to start saving was ten years ago, but we promise you that the next best time is now. 2020 may have had its fair share of difficulties, let’s make sure money isn’t one of them.

Fundbae is available to users on Web and Android platforms. For more details and to know how this works, visit their WEBSITE or follow them on all their social media platforms @fundbaeng.

—————————————————————————————————————————————————————-Sponsored Content