Career

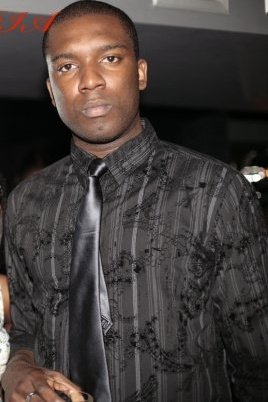

Move Back To Nigeria: UK Based Investment Banker, Nnamdi Akwaeze Shares His Views on the Move Back Trend

Move Back to Nigeria is a series on BellaNaija which aims to encourage young and not-so-young professionals in the diaspora who are trying to make the decision of whether to move back to Nigeria. In collaboration with the brilliant team at MoveBackToNigeria.com, we hope to bring you a weekly interview with individuals who have successfully made the leap, considering the leap, as well as those who have tried it and realized it is not for them. MoveBacktoNigeria.com’s mission is to showcase stories of Nigerians abroad who have moved back home and are taking giant strides, often against all odds and to serve as inspiration to others.

Move Back to Nigeria is a series on BellaNaija which aims to encourage young and not-so-young professionals in the diaspora who are trying to make the decision of whether to move back to Nigeria. In collaboration with the brilliant team at MoveBackToNigeria.com, we hope to bring you a weekly interview with individuals who have successfully made the leap, considering the leap, as well as those who have tried it and realized it is not for them. MoveBacktoNigeria.com’s mission is to showcase stories of Nigerians abroad who have moved back home and are taking giant strides, often against all odds and to serve as inspiration to others.

This, however, does not preclude us from sharing stories of the people who have moved back and are facing various challenges. This week, we catch up with Nnamdi Akwaeze, a Chartered Accountant and Investment Banker currently working and living in London. While he has not formally moved back to Nigeria yet, we believe this interview is particularly interesting from the perspective of a Nigerian still in the diaspora and considering his options for moving back home. In this interview find out his views on the trend of repatriation by the ‘Nigerian Diaspora’; his views on the key barriers preventing Nigerians abroad moving home; as well as his recommendations on the key investment opportunities every Nigerian in Diaspora should be taking advantage of back home.

Can you please introduce yourself and tell us who you are?

My name is Nnamdi Chinedu Akwaeze, I’m a Chartered Accountant by profession, and I work for an Investment Bank in London. On the side, I’m interested in doing other businesses away from work.

You work in the city of London, but where did you grow up?

I grew up in Lagos Nigeria. I attended Corona Primary School, and afterwards went to Atlantic Hall for secondary education.

Thanks! After your secondary education, what came next?

I left Nigeria and moved to the UK to study. First I did my A levels and then University afterwards. At the time there were a lot of concerns about the state of things in Nigerian Universities, riots e.t.c and I guess my parents didn’t want me to be a part of that, so they worked hard and paid for me to study abroad.

Ok so what did you study when you arrived in the UK?

My A levels was a 1 year intensive course at Reading University. For my A levels, I did Mathematics, Economics, and Computing & Statistics. The course was designed for International students as a feeder into the Undergraduate Programme at Reading University. At Reading, I studied Accounting and Economics for my Undergraduate Degree, and then I went on to do a Masters in International Securities and Investment Banking at the International Capital Markets Association School, which is associated with Reading University.

Great, so you studied Accounting and Economics. Is this what you always wanted to get into?

It’s funny because in High School, I was in the Sciences, and studied Physics, Chemistry and Biology, and I was very good at it. The reason I switched to Accounting & Finance is because I like to believe I have a lot of talent; some of it is creative, others in the sciences, and I didn’t want to study my talent. I wanted to study something that would help me use my talent in the future, so I studied Accounting and Economics to help me run a business in future.

The Nigerian culture seems to require one to have a Masters Degree, is that why you got the degree

In terms of Banking & Finance, you have Accounting, which tells you about the numbers, you have Economics (demand and supply), and also you have Investment Banking which is how people move money around to invest in projects. So my undergraduate was in Accounting and Finance and my Masters was in Investment Banking. I did the Masters just so I could have a good balance of both subject areas, and the idea for me was always to get into an Investment Bank at some stage in my career, so doing both degrees for me was quite important.

After your Masters Degree in Investment Banking (IB), did you then go to work in an Investment Bank?

No. I had the opportunity to get into Investment Banking straight away, but from discussing with family, they were keen that I did not go straight into it. They advised me to train as a Chartered Accountant, qualify, and then go into an Investment Bank. This was because if for any reason in future, I needed to go into another industry, then at least I had the accountancy qualification to help me make the transition. It was a way of hedging my future.

Presumably you then went and got an accountancy qualification first? Where was this and what did you do?

It was quite difficult to get a training contract with any of the accountancy firms in London, because I was a foreign trained student who required a work permit. I worked hard, and in the end got into KPMG, training there for over 3 years and ending up getting qualified there as a Charted Accountant. My role was mainly auditing, so going into external firms and auditing them. Tax, M&A and a lot of other Finance Infrastructure projects were also a part of the job. For me it was a good way to go into different companies and businesses to understand how they work. After this, I switched into Investment Banking.

When you finally got into Investment Banking, was it what you expected?

I joined an American Bank in the Commodities Division, working with products such as Coal, Gas, Emissions, and Freight. I was expecting the hours to be a lot longer than what my experience was at KPMG. Many people said things like Investment Banking working hours were 20 hours per day, but it’s funny because I actually worked longer hours at KPMG. Don’t get me wrong, the work is tough, more aggressive, the pay is better, but for me in terms of work life balance I found things better. Maybe that’s because I’m in the ‘Finance’ department opposed to the ‘Corporate Finance’ department where hours may be much longer. After my stint at this American firm, I got to understand commodities, then I moved on to do an ‘Exotics and Hybrid’ role with derivatives at another bank. Following this I moved to my current role at a European Bank, were my role is more high level, looking at the bank from a global perspective and ensuring senior management is aware of what the businesses is doing globally, from a very high level perspective.

Interesting! Many Nigerians are known to have ‘side hustles’. Is there anything else you are involved in besides your day job?

I think it’s not just Nigerians, everyone has a side hustle. Even my bosses at work are involved in one thing or the other. Some of them do sports, some of them go travelling, some go into property e.t.c and that’s the same with me. I always make sure I’m doing something on the side. My outside work life is divided into the social and hustle. Socially, I run NCITY in London, which is a series of events that help to bring Nigerian, and other African professionals in one place to understand what’s happening professionally. You do not have to be a Nigerian to attend, but the idea is we want to attract professionals who are interested in the African professional space. Nigeria is where it’s at; so we want to bring people together to network and talk about building and investing in Nigeria.

Ok while we are talking about Nigeria, what is your view on the recent trend of the Diaspora moving back to Nigeria to build their careers?

I think that trend is brilliant. I think it’s good, I think it’s what we need. However, I think there’s a lot of barriers to getting that done. For example, a guy who is married with children who has worked his way up the career ladder abroad all of a sudden has to move back to do NYSC? How is he expected to then look after his family for that one year of NYSC? There are a lot of people who are keen on moving back, but I think the Nigerian Government needs to have a platform whereby people who are looking to move back can make the transition a lot easier. If that happens, then we would probably witness an acceleration in the number of people moving back home.

But there are companies in Nigeria that will pay your fair market value even if you have to go and do NYSC. Surely it comes down to negotiation?

Yes that’s possible, but that doesn’t stop NYSC from being a barrier. At the end of the day people with the NYSC certificate are at an advantage over those who don’t have it, so let’s not brush that aside. I think the best way to deal with NYSC is to have a system where if you are international, you can join a company without doing NYSC, and then be given some time e.g. 3 or 4 years to complete the NYSC while keeping your job. If you then fail to do your NYSC within that period you lose your job, but the idea is not to be required to have done your NYSC as a prerequisite to getting a job.

You mentioned earlier about investing in Nigeria as a member of the Diaspora. Do you think its important for the Diaspora to invest back home? And what are the key investment opportunities in your view?

Personally I think if you have a Nigerian background (i.e. you grew up there), and you don’t investigate opportunities to invest back home then that’s unwise. Usually a lot of people are looking for the next big thing such as the next big Oil Block or Government Contract, and simply don’t act if they don’t get those opportunities. I think it’s important to start little. Take £600 (160k naira), go and buy some little piece of land in the outskirts of some town somewhere. You might think that’s little now, but in 15 years, that 160k Naira could be multiples the value you paid for it. If you keep doing that, i.e. every 6 months you buy some land worth say 200,000 Naira, then in 2 years you have 4 plots of land. In 15 years, the value could be worth 20 – 30 million Naira. And I think land and property is prime in terms of investing in Nigeria. However you have the risk of people getting swindled, so you have to be careful.

You seem to have a strong connection with Nigeria, but what about you yourself, do you have any plans to move back?

Well this thing about moving back, I think needs to be properly defined. Does moving back mean I’m permanently based in Nigeria? Or does moving back mean being invested in the country? For example I’m here in the UK, but I pay NEPA bills and staff salaries in Nigeria. I collect rent; buy land, same as anyone on the ground will do. When I go home I catch up with my same friends, so I see myself as in Nigeria, only that I’ve been here for a while. However, to answer your original question, in terms of me being permanently based in Nigeria, yes I definitely have plans to do that, and that’s why I’m taking these small steps. I think a lot of people want to just go to Nigeria overnight. I think it’s possible, but you have to have something planned. I’ve seen many people move back to Nigeria and then they come back because they did not plan properly. That’s why what I’m doing now is investing and researching my options, making connections with contacts back home, and then I will move afterwards. So I have one leg in and one leg out. For me, it’s going to be a gradual process.

Ok but do you have timelines for when you will move back?

I think it’s good to have timelines, so you are strategic, but it all depends on events. One has to think about getting good housing, transportation, etc. You might plan to move back in 2 years but it might not happen in 2 years because certain events happened to modify your plans. Personally, my timeline is ‘as soon as possible’ i.e. once I have achieved the key things I need. If they are achieved by tomorrow, then I will move back tomorrow. So I don’t have any specific timelines, but when I get these things ticked, I will make the move.

You mentioned NYSC as a barrier to moving back, in your view, what are the other barriers to moving back?

I think some of the other issues are power, traffic and so on; the usual suspects. If you want to have a meeting and you are on the mainland, and you want to go to Ikoyi, you might miss that meeting because of traffic – the transportation network, but I guess that comes with the territory. But there are pluses such as our good warm weather. You could stay in Europe with the good infrastructure, but with terrible weather.

In your view, why haven’t we in Nigeria yet achieved the robust infrastructure many in the Diaspora are now used to?

It’s due to things like corruption obviously. We all cry about it, but what can we do about it? I think things are going to change by proper engagement with the private sector. We need large private institutions that are relatively free of corruption. Coca Cola is immune from politics, Cadbury is immune from politics, Dangote Group is immune from politics. If there is a coup tomorrow, Coca Cola still continues. We need to think about how we can have more of these big institutions in the private sector, and remove a lot of the essential services from Government control. If we do this then we can begin minimising corruption. In reality yes we might have a little corruption in the Nigerian private sector, but at least there is competition, so corruption is less. The owner of GLO is not going to sell fake recharge cards because if he does that then he will lose his customers to other providers and he will not make money.

Ok so you support the privatisation of the Power Assets in Nigeria?

Yes. Nigeria will change overnight if we had constant power. Power is the fuel behind which everything in the country runs. When we have constant power, our GDP will quadruple overnight because the tailor or electrician in Ilupeju or Oshodi can get on with their business, produce more and make more money. If you have a mill that produces rice, production goes up, at less cost (ex diesel costs) which increases profitability. We need constant power and everything will fall into place. Power is the key to our quick and rapid development.

Finally if you had to say anything to Nigerians in Diaspora who are looking to move back, what will you say to them?

If you want to move back, do your research. By all means feel free to just take the plunge and experiment but only do that if you are single and young and not married. But if you are in a situation where you need stability then definitely plan it well. Where are you going to live? Where are you going to work? Etc. you need too answer all these questions before you move back, if not you could regret your decision. Also while you are here don’t spend all your money on drinks. Invest back home, buy land or something. Instead of buying champagne for £1000, invest it on land in Lekki.

Many thanks for your time and best wishes moving forward.

______________________________________________________________________________________________________

The primary objective of MoveBackToNigeria.com is to connect Nigerian professionals with various opportunities in Nigeria, ranging from recruitment drives to information & support regarding relocation processes, financial & tax advice and much more. Move Back To Nigeria also features social interest topics such as what’s on, where to live, how-to survival tips and so on. Consistently engaging with and featuring Nigerian professionals in weekly interviews, Move Back To Nigeria regularly publishes social interest articles relevant to the general public. Everyone is welcome to their online discussions & fora and you are invited to air your views & suggestions on the topical and trending matters section. For more information and further inquiries, please contact [email protected].