News

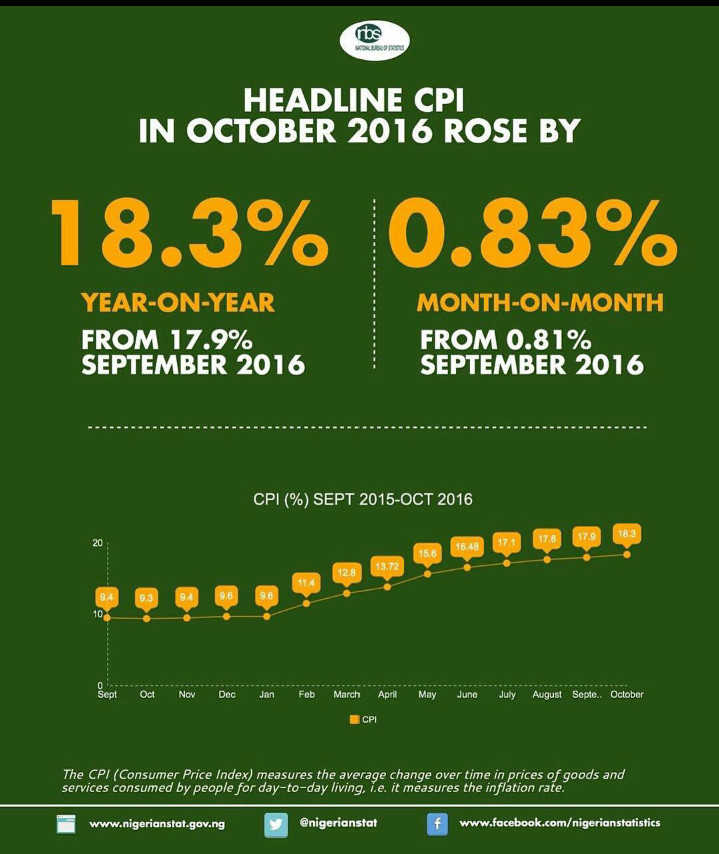

Nigeria’s Inflation Rate Hits 18.3% in October

The National Bureau of Statistics (NBS) says Consumer Price Index (CPI) has increased to 18.3 per cent (year-on-year) in October from 17.9 per cent recorded in September.

The National Bureau of Statistics (NBS) says Consumer Price Index (CPI) has increased to 18.3 per cent (year-on-year) in October from 17.9 per cent recorded in September.

The CPI, which measures inflation, is 0.48 per cent points higher from the points recorded in September.

A report released by the NBS in Abuja on Monday noted that increases were recorded across almost all major divisions which contributed to the Headline Index.

“Communication and Restaurants and Hotels recorded the slowest pace of growth in October, growing at 5.7 per cent and 9.4 per cent year-on-year respectively.

The Food Index rose by 17.1 per cent (year-on-year) in October, up by 0.47 per cent points from 16.6 per cent recorded in September.

During the month, all major food groups which contribute to the Food sub-index increased with fruits recording the slowest pace of increase at 11.5 per cent,’’ it said.

Price movements recorded by the All Items less farm produce or Core sub index rose by 18.1 per cent (year-on-year) in the month under review.

According to the report, the Core Sub Index, which rose by 18.1 per cent in the month, is 0.4 per cent points higher from rates recorded in September, which was 17.7 per cent.

“During the month, the highest increases were seen in housing, water, electricity, gas and other fuels as well as fuels and lubricants for personal transport equipment and education.

Significant price movement under the Core Sub-index was also recorded for clothing and footwear, which recorded an increase of 17.8 per cent year-on-year.

The groups with least growth pace recorded in October were communication (5.7 per cent), restaurants and hotels (9.4 per cent) and recreation and culture (10.3 per cent),’’ it added.

On a month-on-month basis, the report said that the Headline Index rose by 0.83 per cent in October, higher from the rate recorded in September (0.81 per cent).

“The Urban Index rose by 19.9 per cent (year-on-year) in October from 19.5 per cent recorded in September and the Rural Index increased by 16.95 per cent in October from 16.4 per cent in September,’’ it stated.