Promotions

Here’s Your Quick Guide to Effortless Payments in Nigeria With Mastercard’s Contactless!

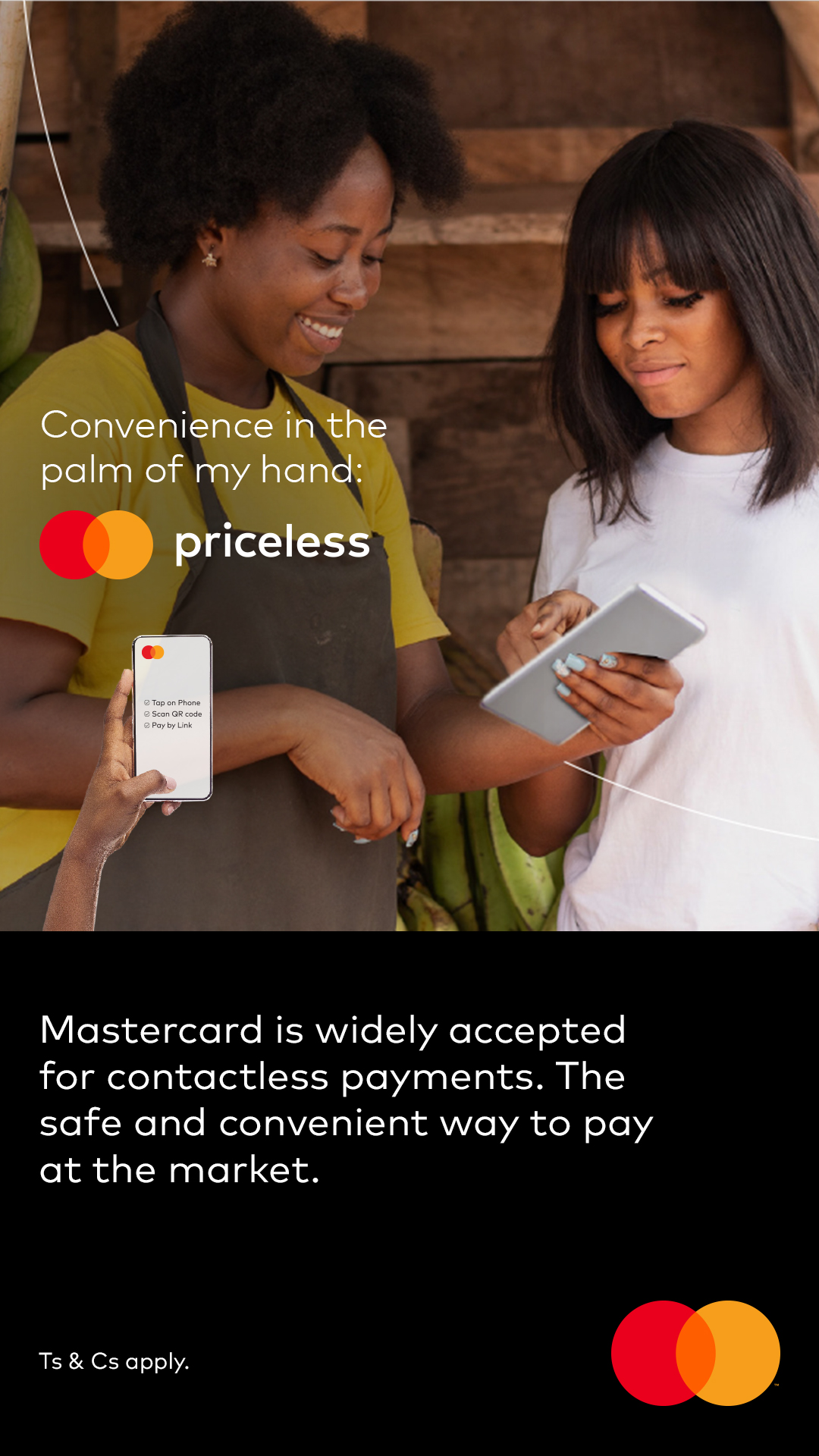

Recently, Mastercard officially introduced its slate of contactless solutions in Nigeria, signalling a new era of payments in the country. Thanks to these solutions, customers can now enjoy a reality in which transactions are more seamless than ever!

Recently, Mastercard officially introduced its slate of contactless solutions in Nigeria, signalling a new era of payments in the country. Thanks to these solutions, customers can now enjoy a reality in which transactions are more seamless than ever!

The impact of these solutions extends beyond individual transactions. Small business owners are now equipped with a powerful tool – their smartphones. These devices, once limited to communication, now moonlight as payment terminals, offering customers a smooth shopping experience – using Mastercard technologies such as Tap on Phone, QR Link2Pay, or Pay by Link.

For those eager to join the new era of payments, check out the solutions and how they work below:

Tap On Phone

Businesses

Businesses interested in utilising Mastercard’s Tap on Phone feature only need to follow the following phases and steps:

Phase I: Onboarding:

- Step 1 – Start with an NFC Android Device.

- Step 2 – Download a dedicated Tap on Phone app via the app store.

- Step 3 – Request set up from your bank.

- Step 4 – Receive credentials.

- Step 5 – Sign in with credentials.

- Step 6 – Start transacting.

Phase II: Receiving Payments:

- Step 1 – Log in to the app after successful signup.

- Step 2 – Input the amount of the purchase made.

- Step 3 – Select card variant.

- Step 4 – Tap NFC enabled card on the NFC antenna of the device (Note: The antennae is usually located at the back of the device.)

Cardholders

For cardholders, all recently issued and future Mastercard cards are NFC-enabled, so no need to go through any onboarding process! All you need to make payments is to follow the steps below:

- Step 1 – Tap your NFC-enabled card on the mobile device.

- Step 2 – Enter your card pin.

- Step 3 – Select account type i.e., savings or current.

- Step 4 – Wait for payment confirmation on the merchant’s device – provided they are contactless enabled.

QR Link2Pay

- The consumer scans the business’ QR code via app or enters an alias and confirms the transaction amount to initiate payment.

- The payment app provider (bank or wallet provider) sends a payment request to Mastercard using QR APIs.

- The consumer’s bank debits the amount, and Mastercard validates and routes the payment request to the business’ bank.

Once payment is approved, the business’ bank credits the amount and notifies them.

Pay by Link

- After the purchase and the amount has been entered by the business, the consumer must choose Pay with Link as the preferred mode of payment.

- The business generates a unique link/URL. This link can be shared by mail, text message, instant message or any available channel.

- Following the link, the consumer can pay with their card saved within their click-to-pay profile.

Once the transaction is complete, the consumer and the business receive a confirmation of the payment.

Ready to ditch the cash and card shuffle? Mastercard’s contactless solutions are your ticket to a world where payments are easier than ever! Embrace the future of payments today!

For more information on the solutions and how to get started, click on this link: Low Cost Acceptance | Mastercard MEA

Sponsored Content