Career

Smart Money with Arese: How to Survive in a Struggling Economy When You’re not a Millionaire

Unless you are Linda Ikeji (Aunty Linda I hail o!) or a few lucky buggers I know, 2015 has been a struggle year! Struggle might even be an understatement in certain industries but lets just say the year has been riddled with a lot of financial mishaps.

Unless you are Linda Ikeji (Aunty Linda I hail o!) or a few lucky buggers I know, 2015 has been a struggle year! Struggle might even be an understatement in certain industries but lets just say the year has been riddled with a lot of financial mishaps.

Everything bad seemed to attack the Nigerian economy at the same time, and it all began in the last quarter of 2014. Capital flight caused by a combination of Ebola and uncertainty regarding the elections. (In simple English ‘all the oyinbo don run comot with their money’). Let’s not forget falling oil prices, inflation, devaluation of the Naira and the subsequent currency controls put in place to stop the Naira from going into free fall – which seem to have made doing business in Nigeria much harder.

The good news is, we are Nigerians and we’ve literally been through worse and survived. Despite all the times they’ve told us the sky is falling, it hasn’t fallen on our heads so far. Instead of complaining, we need to be resilient and get comfortable with being uncomfortable, knowing that it’ll be a tough road ahead but trusting that we will survive it.

Here are some tips to help you survive.

Get comfortable with the phrase ‘I can’t afford it’.

Going on holiday is something that makes me supremely happy, I plan ahead, create budgets around everything I’m going to do and start setting money aside towards one luxury item. (A treat to myself for working hard). However, this year was slightly different because all the savings that came from buying tickets months in advance and planning ahead didn’t count. The devaluation of the Naira meant that I had to reprioritize and adjust my mindset.

‘It was hard to discipline myself o, I can’t even lie’! I had already fallen in love with a bag…beautiful grey leather and gold hardware. *Le sigh * I dragged my BFFs to the store several times and we weighed the pros and cons. In the end I decided that even if I had the money in my account, I couldn’t afford it.

My friends abused me and said I was being stingy to myself because as far as they were concerned I could afford it. But could I really afford it? Yes, I had saved enough to buy it; but the economy was worsening. Life was generally getting more expensive, and my income was the same. So was it prudent to be spending at the same rate with so much uncertainty? I decided it was smarter to adjust my budget and concentrate on spending on eating out at nice restaurants and experiences for my daughter that didn’t cost a lot (i.e. trips to the zoo, picnics at the park, Kidzania) Things that were infinitely cheaper than what I had initially planned, because the money saved would be better spent towards topping up my emergency fund or investing in something that would move me forward financially.

I usually don’t like to think about money from a scarcity mentality but “I can’t afford it” is my new favorite phrase. Strange? Yes, but it is temporary. It’s a phrase that is usually shrouded by so much shame but I think its something we need to embrace as a society. We like to suffer and smile and pretend that everything is ok and then make bad spending decisions to make sure other people think we are ok but saying I can’t afford it doesn’t kill and it certainly doesn’t make you less of a person. It simply means I can’t do this particular thing right now. So say it with confidence.

Start a spending diet

It doesn’t matter whether you earn N50, 000 a month or N2, 000,000 a month, the cost of living in Nigeria has increased and in order to make sure we are not hustling backwards we have to adjust our spending and budgets accordingly.

Unfortunately, the less you earn, the more important it has become to cut your spending. It is not fair but it’s the harsh reality. The more expensive things become because of inflation, the more people who have lower disposable income, are going to have to cut costs on. This applies to even the aspects of their budget which they consider as ‘needs.’ They don’t have to be drastic changes; they can be small and incremental changes that will make a difference in the long run.

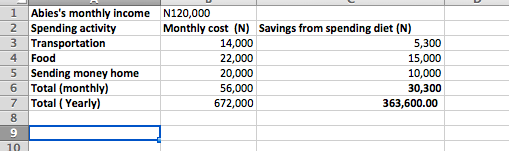

For example, Abies earns N120, 000 a month. She lives in Ketu and works in Victoria Island. Her company has started laying people off in droves; and although she feels like a valuable addition to her team, she no longer has job security. Since the probability of earning more seems unlikely for her (given the economic climate) she decided to look at her current expenditure and was determined to find ways to cut her spending. After tracking her expenditure for the month. Sadly she realized that the three biggest line items were things she considered necessities. Transportation, food and the monthly stipend she sent to her family in Benin every month. She decided to see how she cut cost in these areas.

Although she took pride in the monthly stipend she sent home to Benin every month to help look after her parents, she knew if she didn’t reduce the amount she sent from N20,000 to N10,000. She would have no one to look after her in the event that she lost her job.

Transportation cost her on average of N650 a day to get to work and back home. The actual bus fare cost her about N500 going and coming, but she spent an extra N150 on two ‘Keke- Napep’ trips, that would take her from her office to the bus top and another from the bus top in her area to her house. She decided to join the ‘fit–fam’ and walk to the bustop instead of taking the ‘Keke Napep’.That slight change saved her about N5,300 a month.

She currently spent an average of N1000 a day on food, so she decided she would cut costs by eating more ‘mama Daniel’ and less Sweet Sensation. This saved her about N15,000 a month.

In total Abies was able to save N30,300 a month and top up her emergency fund. If she still has a job and is consistent with her savings goals, in 12 months she’ll have N363, 000 in her emergency fund, which is nothing to sneeze at when you earn N120,000 a month.

Don’t wait for a crisis to happen before you view your finances differently. The economy is probably going to get worse before it gets better; nothing has reinforced having an emergency fund like the current economic situation. We need to prepare ourselves by ensuring we have a financial cushion to rely on when things get tough.

Even in a bad market…seek opportunities

‘Fortunes are built during the down market and collected in the up market’-Jason Calacanis

Don’t get it twisted, as bad as things are, a new set of millionaires will emerge after this crisis from several sectors, because while the rest of us are complaining about how bad the economy is they are leveraging on the opportunities that every crisis ultimately presents. Those who can save or have liquidity are picking up assets that are currently undervalued (i.e. stocks on the Nigerian stock exchange) or distressed assets (i.e. buying real estate for cheap from those who need to sell in a hurry to create liquidity)

For example despite the state of the economy, The Nigerian Telecoms industry is one of the fastest growing in the world. Broadband adoption is on the rise with about 150 million lines and over 80 million Nigerians now have access to the Internet. In my opinion the new rich kids on the block will be the internet millionaires who are leveraging on the improved technology to create platforms. It is fact that despite the difficult times, we are eager to consume content and hence are always on our phones or computers. The real winners are going to be the people who can create brands and platforms that traditional businesses can leverage on to reach a new audience.

‘There is always money being transferred around you, you just need to know where to intercept it’.