News

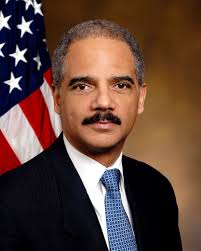

Former US Attorney-General Eric Holder in Nigeria to help MTN negotiate $3.9bn Fine

MTN stepped up efforts to negotiate a $3.9 billion fine by the Nigerian Communications Commission (NCC) for failing to disconnect unregistered sim cards, by hiring a former US Attorney-General Eric Holder.

MTN stepped up efforts to negotiate a $3.9 billion fine by the Nigerian Communications Commission (NCC) for failing to disconnect unregistered sim cards, by hiring a former US Attorney-General Eric Holder.

What Happened?

The NCC had fined the MTN $5.2 billion for its failure to disconnect 5.2 million unregistered subscribers on its network by the August 2015 deadline and asked it to pay up by November 16, 2015.

Negotiated Fine

However, the fine was reviewed downwards by 25 per cent with a fresh payment deadline of December 31, 2015 after appeals by the company.

Last Minute Court Appeal

MTN then approached the Federal High Court sitting in Lagos a few days to the payment deadline, challenging the legality of the fine. By the time the matter came up for hearing in January, the telecoms company through its counsel, Wole Olanipekun (SAN), requested an out-of-court settlement and requested a 60-day window to sort things out with the NCC.

The court obliged him in part, adjourning the matter till March 28, 2016.

Why Holder?

According to the Financial Times of London, the MTN might have finally settled for former US Attorney-General Holder to help it negotiate the fine, put at 95 per cent of its annual turnover in Nigeria, because of his experience in handling such matters.

Holder was one of President Barack Obama’s longest serving cabinet members. He held office from 2009 to 2015 before returning to Washington-based corporate law firm Covington and Burling after standing down as attorney-general in April 2015.

“His experience as attorney-general in dealing with corporates with a lot of problems was interesting to MTN,” the paper quoted someone close to the negotiations, adding that the telecom company hoped his “experience and stature could inject some balance into the equation”.

As US attorney-general, Holder presided over the biggest corporate settlements in US history. These included the $13 billion that JPMorgan Chase paid over the sale of mortgage-backed securities before the financial crisis, and BP’s $18 billion fine for the Horizon oil spill.

MTN Fine is Startling even for International Standards

The MTN fine is much larger than those handled by Holder in the US but it hopes that he would be able to help it make a head way in its attempt to get better deal away from the current $3.9 billion which threatens to wipe off 95 per cent of its annual earnings from its largest market with 62 million subscribers, representing 42 per cent of the group’s network.

Government not budging on the Fine…for now

Holder reportedly set to work with an initial visit to Abuja last month to plead with senior government officials on behalf of the telecoms company but had apparently not been able to find favours with the regulatory authority contending that the fine was computed strictly according to the regulations set out in 2011.

The MTN appeals had been falling on deaf ears, according to the NCC sources, because the telecom company had acted in contempt of the regulatory authority’s several warnings about the dire consequence of its failure to disconnect unregistered sims by the August 25, 2015 deadline.

Why the NCC imposed such a huge fine

NCC sources also said MTN failed to respond to warnings about how unregistered sim cards were used by criminals and Boko Haram terrorists to evade surveillance. Security chiefs had been particularly incensed, they said, when a terrorist commander was captured with dozens of MTN sim cards after the deadline set last August for all telecom groups to disconnect unregistered subscribers.

“At first there were lots of people who said this was a bad signal for foreign investors but when they looked into it they realised that MTN had really messed up,” an official said.

Will this massive fine scare investors?

The Executive Vice-Chairman of NCC, Prof. Umar Danbatta, had allayed fears that the fine was punitive enough to scare away foreign investors when he said the penalty was open to favourable review. This might have encouraged the MTN to review its court option in favour of the engagement of a negotiator of Holder’s status to help it find a soft landing.