Promotions

This Survey by FinMark Trust & EFInA Reveals the Rate of Reduced Income in Nigerian Households during Lockdown

By Oluwatomi Eromosele (Research Officer, EFInA)

A recent survey carried out by FinMark Trust through the i2i initiative, in partnership with EFInA, reveals that some Nigerian households are beginning to experience reduced income, lower food consumption, and reduced access to financial and health services following the onset of the COVID-19 epidemic and related lockdowns. The survey, conducted via mobile phones, was commissioned to generate more complete and inclusive data on how the COVID-19 pandemic is impacting the lives of Nigerians. The survey is nationally representative of the Nigerian adult population (18+) as more than 1,800 adults were surveyed between April 8 and 16 via telephone. Similar surveys were also carried out in Kenya and South Africa. Click here to register for the upcoming webinar where this will be discussed in detail.

Health effect

Beyond the direct impact of COVID-19 on those infected, there is an indirect effect on global health supply chains. 14 percent of adult Nigerians report the inability to access medicine in the week prior to April 8, mainly due to a lack of funds and unavailability of medicines. 45 percent report some form of an increase in the price of medicines. The majority of Nigerian adults are adopting recommended health behavior changes following the onset of the pandemic, such as increased washing of hands, staying at home, limiting contact with other people, avoiding group functions, and using hand sanitizers. However, 32 percent say it is not very likely and 11 percent say it is not at all likely that they would seek medical care if they had mild symptoms such as cough or fever.

Socio-economic effect

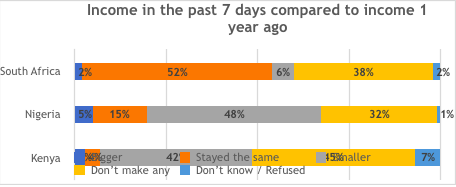

Nearly half of the adults report that income earned in the week prior to April 8 was smaller than the amount earned at this same time last year. This is not surprising, as the EFInA Access to Financial Services in Nigeria 2018 survey found that approximately 50 million adult Nigerians earn their income either daily or weekly, and movement restrictions have likely reduced income-earning opportunities for some Nigerians.

Source: (Jeoffreys-Leach, S. et.al, 2020)

Furthermore, 64 percent of farmers report difficulty in selling crops or livestock. This signifies a threat to food security with the possibility of further hikes in food prices. With disruptions in supply chains, not only will available food not get to the markets, but farmers may also not have enough capital for the next planting season if they cannot sell profitably this season.

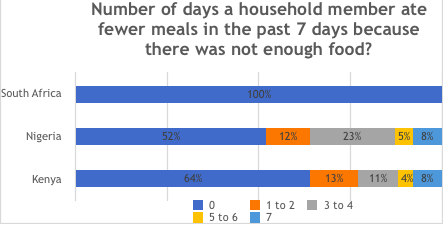

Nearly half of Nigerian adults report at least one day in the week prior to April 8 in which a household member ate fewer meals because there was not enough food. The picture is less bleak in Kenya while South African adults report no incidence of decline in meals.

Source: (Jeoffreys-Leach, S. et.al, 2020)

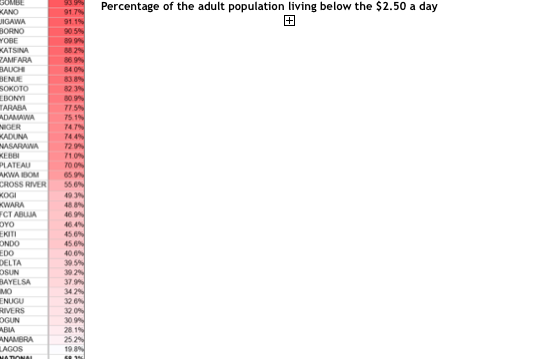

This research has shown differences in the impact of the pandemic across the countries surveyed; similar differences are likely to be evident within countries as well. While the initial impact may be felt most in the first states with complete lockdowns, underlying poverty across various regions and rural versus urban spread will also play a role in determining the most hit areas. For example, Nigeria’s poor are disproportionately concentrated in Northern Nigeria with the North East and North West accounting for 51% (30m) of adults living below the $2.50 poverty line.

Source: EFInA Access to Financial Services in Nigeria 2018 Survey

The reported rapid increase in COVID-19 cases in Kano state is a warning that we cannot afford the spread of the pandemic in the North. If in Lagos state where 1 in 5 adults live below the poverty line, the popular refrain is that ‘Poverty will kill us before coronavirus’, one can only imagine what will be the case in Kano state where at least 4 in 5 adults live below the poverty line. As the poor get more desperate for food and essentials, the result is a threat to the security of lives and property. 44 percent of adults already report an increase in crime in the 14 days prior to April 8, and 25 percent of adults are extremely worried about their personal safety and that of their family members.

Access to Financial Services and Financial Health

The role of financial services in improving livelihoods is particularly important during a crisis. People need access to affordable savings, credit, payments, insurance, and pension solutions to either increase their ability to take advantage of economic opportunities or build resilience against income shocks. However, Nigerians reported disruptions in access to financial services following lockdowns.

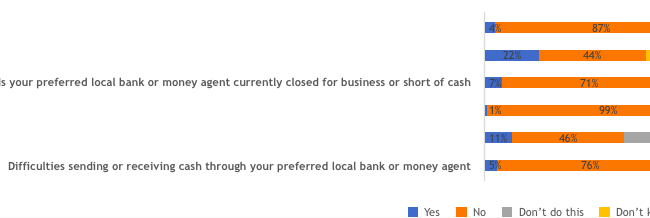

Source: (Jeoffreys-Leach, S. et.al, 2020)

11 percent of Nigerian adults reported difficulty remitting through their preferred bank or financial service agent and 1 in 5 percent said their preferred bank or agent was closed or had run out of cash when they were interviewed in mid-April. Although Kenya and South Africa have been experiencing similar lockdowns, just 7 percent and 3 percent of adults in those countries respectively reported closure of their preferred financial access points. Widespread use of mobile money in those countries, and the related expansion of agent networks, has allowed the uptake of digital financial services to flourish. Increasing scarcity in financial access points appears to have impacted the cost of transactions, as 1 in 5 adult Nigerians report higher prices charged by agents.

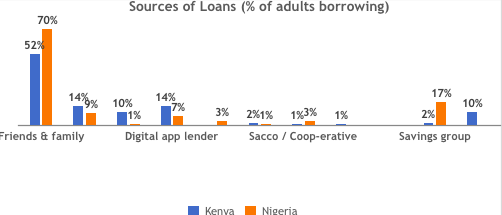

Nearly 1 in 5 adult Nigerians borrowed money in the two weeks prior to April 8. Of these, 8 percent have taken up loans from formal financial service providers, mainly digital lenders. Most Nigerians who reported having taken credit borrowed from family and friends. Informal financial service providers catered to 29 percent of those borrowing, with nearly one-third of informal loans sourced from money lenders. Without regulatory oversight, borrowing from money lenders can be risky due to potentially high-interest rates and the possibility of exposure to aggressive debt collection practices.

Source: (Jeoffreys-Leach, S. et.al, 2020)

Only 12% of Nigerian adults said that it would be at least somewhat possible to raise N45,000 (1/20th of Gross National Income per capita) within a week to meet a sudden need, such as an unexpectedly large medical bill. Half of the adults said it would not be at all possible to raise this amount in 7 days. Of those who said they would be able to raise this amount of money, 4 in 5 would rely on their savings, loans from employers, regular earnings, and/or increased working hours to raise this fund, while the remaining 1 in 5 would look to informal financial service providers as well as family and friends. Again, just about one percent would expect to borrow from formal financial institutions such as banks to raise additional income needed to cope with financial shocks.

What can be done?

Over the years, EFInA has worked with stakeholders in the financial sector to increase access to financial services as a pathway to improved livelihoods. With the widespread use of mobile phones in Nigeria – 85% of adult Nigerians either own or have access to a mobile phone – digital financial services provide an opportunity to extend affordable, reliable solutions to Nigerian adults who are financially excluded. The impact of the COVID-19 pandemic further highlights the need to urgently expand digital financial services in Nigeria.

Financial inclusion stakeholders must work to:

Rapidly expand the use of digital financial services, which can help people process necessary financial transactions to sustain their businesses and households while minimizing movement and physical interaction. By making digital money transfers, governments, and others providing financial support to the most vulnerable can reach them more safely and efficiently than by distributing cash. Widespread use of digital financial services can also build financial inclusion and accelerate recovery from economic shock. Widespread deployment of Payment Service Banks holds the potential to accelerate financial inclusion, particularly in hard to reach areas.

Leverage financial service agent networks, and support agents in operating safely. As local, trusted members of their communities, agents can help Nigerians access financial services without having to travel to bank branches. Agents also hold the potential to contribute to crisis response, as trusted partners who can deliver money, supplies, or potentially even information within their communities.

Accelerate innovation. Shifting to a new normal provides new challenges, but also opportunities as we all start to work differently. Now is the time for regulators and financial service providers to test new approaches, new partnerships and new solutions as we work toward the joint goal of coming out of the COVID-19 pandemic with the tools needed to build a stronger, more resilient economy.

The data for Nigeria and other countries is available online and more details about FMT and i2i can be found here & here

For more about the impact of COVID-19 on Nigeria and financial inclusion, visit the site

———————————————————————————————————————————————————————————–Sponsored Content