News

USSD Transactions will Now Cost Nigerians a Flat Rate of ₦6.98

Governor of CBN – Godwin Emefiele

The Central Bank of Nigeria (CBN) has issued a new order that introduces a new flat fee of ₦6.98 for consumers who use USSD, effective Tuesday, March 16.

On March 15, telecommunications operators were expected to begin removing the Unstructured USSD short code service that banks and other financial service providers rely on to support the banking sector.

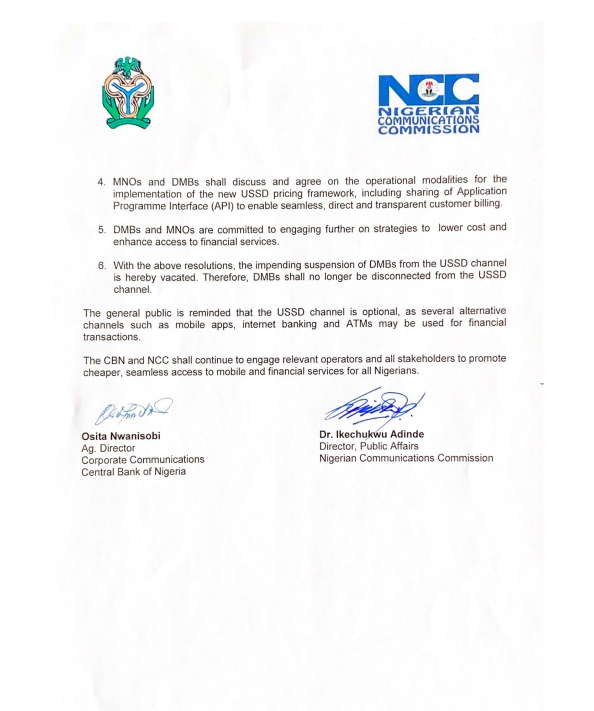

In a joint statement with the Nigerian Communications Commission (NCC), CBN said the new fee was part of an agreement reached when banks and telecommunications operators met on Monday to discuss the ₦42 billion debt owed to mobile operators by commercial banks.

It stated:

Mobile Network Operators (MNOs) and Deposit Money Banks (DMBs) have had protracted disagreements concerning the appropriate USSD pricing model for financial transactions.

This resulted in the accumulation of outstanding fees for USSD services rendered leading to potential service withdrawal by the MNOs.

We are pleased to announce that after comprehensive deliberations on the key issues, a resolution framework acceptable to all parties was agreed thus:

Effective March 16, 2021, USSD services for financial transactions conducted at Deposit Money Banks (DMBs) and all CBN – licensed institutions will be charged at a flat fee of N6.98 per transaction.

This replaces the current per session billing structure ensuring a much cheaper average cost for customers to enhance financial inclusion.

This approach is transparent and will ensure the amount remains the same, regardless of the number of sessions per transaction.

Read the official statement below:

This comes as Nigeria’s unemployment rate increases to 33.3 per cent in the fourth quarter of 2020, from 27.1 per cent currently. The number is 6.1 per cent higher than the 27.1 per cent reported in the second quarter of last year, according to a study published on Monday by the National Bureau of Statistics (NBS).

Unsatisfied with this, Nigerians have taken to social media to express their displeasure with this new development.

This government is always inventing new ways to add to the hardship of Nigerians. Now we will be charged for USSD banking. As usual we will only complain and go on with our normal lives. Nigerians are truly docile people only loud in matters of insignificance. ?♀️

— NK£M? (@Theladyfrances_) March 16, 2021

Imposes N7 USSD fee. Imposes RUGA. No security. Boko Haram and bandits cashing out. Close borders. Ban crypto. Increase taxes & levies. Impose new levies. Increase utility rates.

There was a country. Nigeria is dead. Support Oduduwa nation.

— IFA FUNSHO (@funshographix) March 16, 2021

You want to promote Financial inclusion but you are increasing USSD transaction charge. Finclusion in the mud.

— Wale Adetona (@iSlimfit) March 16, 2021

Nothing is alleviating us from poverty in this country but rather, some many charges dragging us into more poverty & struggling to make ends meet.

USSD is mostly used by “below” class people without a smartphone to use an app.

Now, they charge you for using it.

What a country

— POOJA… (@PoojaMedia) March 16, 2021

This government want to make Nigeria a hell for every one of us….. USSD charges is very unnecessary. But sha, no matter what they do, "WE SHALL SURVIVAL" what doesn't kill you only makes you stronger. We movee✊

— ???????? (@Mohnice_) March 16, 2021

Banks use Telco infrastructure to power ussd

Banks haven't been paying telcos and telcos threatened to cut them off

So if you were the CBN Gov what would you have done different

— Cinderella Man (@Osi_Suave) March 16, 2021

NAWA O! Na wetin we get for bank wey govt wan charge bank customers to pay N6.98 for each USSD transaction?

These people should come and take our kidneys and rest!

— FS Yusuf (@FS_Yusuf_) March 16, 2021

Yesterday, they said most of us have swim into unemployment.

Today, charges for USSD use.

Tomorrow will be __________

This country ??

— POOJA… (@PoojaMedia) March 16, 2021

Well that marks the end of USSD transactions for me. The money nor too plenty before.

— Ose (@Chief_Umane) March 16, 2021

23.18 million Nigerians are unemployed — NBS.

Inflation hits 17.33%, highest in 4 years.

CBN imposes N7 USSD transaction fee on Nigerians. Bank customers will now pay N7 for each USSD transaction.

Stats coming out from Nigeria everyday, will send the faint-hearted into coma.

— FORTUNATE. (@Fortunate003) March 16, 2021