Promotions

National Housing Fund Scheme presents an opportunity for aspiring Home Owners | Here is how

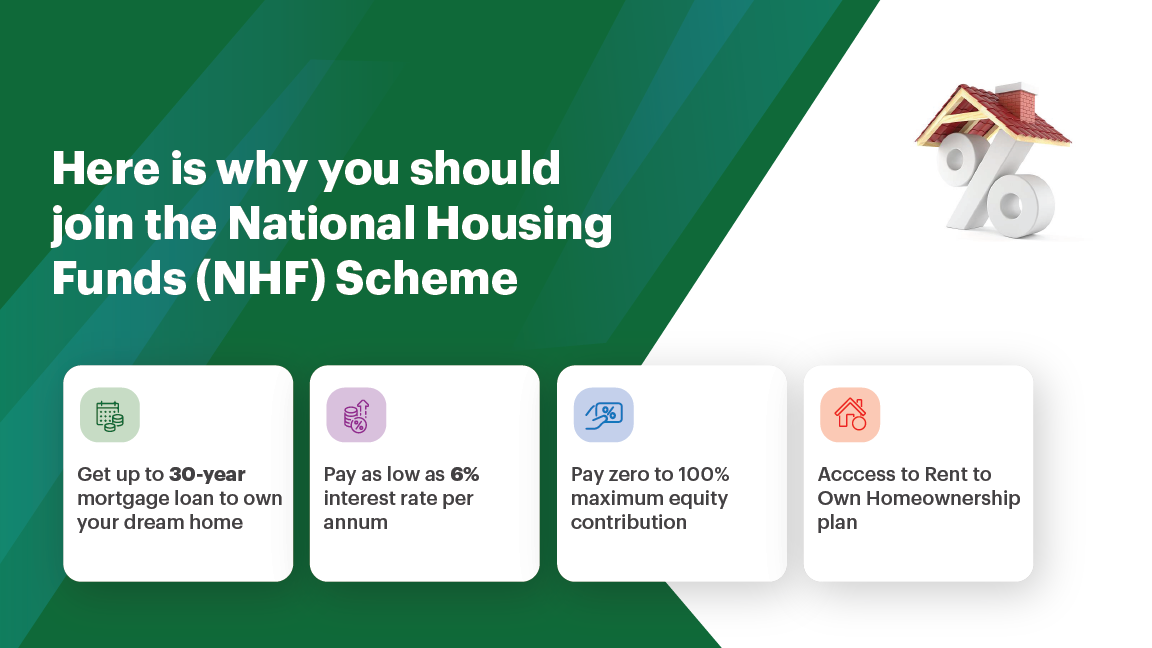

The National Housing Fund (NHF) Scheme is providing an affordable, and convenient way to own your home. Managed by the Federal Mortgage Bank of Nigeria (FMBN), the team has so far made affordable homes possible for over 36,617 Nigerians at best market rates.

Participation is open to all Nigerians eighteen years and above working in the public, private, and informal sectors. This includes civil servants,private sector employees, and self-employed persons such as small business owners, tailors, barbers, digital content creators, comedians, actors, etc.

Registered participants are to contribute 2.5 percent of their monthly income to the Scheme and after six months of consecutive contribution, participants are qualified to access FMBN home loans.

Here are a few of the FMBN Housing Products:

National Housing Fund Mortgage Loan.

The Loan provides up to N15 million at a 6 (six) percent interest rate to NHF subscribers to purchase FMBN-funded homes and non-FMBN-funded homes and features up to 30-year payback. Zero equity for loans below N5M, 10% Equity for

loans over N5 million to N15million.

Individual Home Construction Loan.

The loan provides up to N15m for NHF contributors with unencumbered land, legal title, and approved building plans to undertake self-construction. Tenor: 15 years.

FMBN Rent-To-Own Housing Scheme.

The loan allows NHF contributors to move into as a tenant and pay toward ownership of the property in monthly or annual installments for up to 30 years at an interest rate of 7%.

FMBN Home Renovation Loan.

Provides up to N1million NHF contributors to renovate their homes.

NHF Diaspora Mortgage Loan.

The loan offers up to N50M to Nigerians living abroad to own a home in Nigeria. Terms: 30% equity, 9% interest rate, and a ten-

year payback period.

Interest-Free Rent-to-Own (Ethical RTO) Scheme:

FMBN developed the product to eliminate the challenges that Nigerians who want to own their homes through the National Housing Fund Scheme face because of the interest-based nature of the Bank’s other housing products. The product uses a rent-to-own model that allows beneficiaries to move into FMBN and non-FMBN-funded homes and conveniently pay towards full ownership, using monthly/quarterly, or annual rentals.

NHF Registration is available at all FMBN Branch offices in state capitals nationwide or simply click here to register. You can also call an FMBNHousing Specialist via these numbers or check out their social media handles for more information: 09 292 0690; 0817 023 7904; 0908 797 3000.

Please Note: This is a paid post and we advise that you do your due diligence and proper confirmation.

Due diligence is the responsibility of any interested parties

Sponsored Content