Career

Iroko CEO Jason Njoku Writes About His Experiences with Nigerian Banks on Medium | TwitterNG Responds

If you’ve ever done business in Nigeria, or had cause to seek bank financing, you’ll know that the struggle is really real.

If you’ve ever done business in Nigeria, or had cause to seek bank financing, you’ll know that the struggle is really real.

We found this piece written by Jason Njoku, the CEO of IrokoTV, and we knew we just had to share. The business owner wrote about how becoming a father influenced his decision to make certain lifestyle changes. With this decision, he needed funding… and that was where the story got really interesting!

Here are some excerpts from the article on Medium.

On how it started

So I relented. I’m a grown up, a father in fact. I have to do the right thing. So I told her to find a house in Lagos. Let me go find the financing. Contrary to what most people think, the Njoku’s are absolutely not rolling around in dollars. That $40m raised was for Iroko. Iroko does not = Njoku. I am a founder, CEO and shareholder, and still have to negotiate my salary with my board etc. If they see fit to not increase it, they can 100% refuse to. But granted, I am not complaining. I’m pretty well paid and would sit in the top 3% of salaried earners anywhere in the world. If I lived in London or NY or Paris, I could pretty easily get a $1m mortgage without too much effort. (this isn’t me bragging, it will be apparent shortly).

So she looked in Lekki/Ikeja etc. This is 2014 so ~N167 = $1. We found a few places we liked. N130–150m. ($778-898k). We had some savings so we ‘only’ needed N100m. Again. Globally, I earn in the top 3%. In Nigeria I am pretty certain I am in the 0.01% of salaried earners.

On corporate governance and separating self from business:

So I went to my board and asked if I could borrow the money from Iroko. Inasmuch as they wanted to be supportive, CEOs borrowing money from companies is usually a big fat red flag for corporate governance. So they suggested I do a small secondary and sell some Iroko shares to fund the new house. With much regret, I did just that. In the end, I didn’t buy a house. I bought some land and am plotting how to construct my glass house upon it. Those shares have obviously gone up in dollar value since then. The hope is they will go up significantly more over the coming decades. I hate selling equity. Opportunities in value creation, gone.

On Iroko’s needing more than just ATM services:

We were great customers, I guess. That was until we asked them for a couple of facilities. You know. Beyond ATM and Internet banking.

We were great customers. Until we required them to add value.

N10m overdraft – sometimes it takes time to import and exchange dollars. If I remember rightly, they asked for an equivalent of $100,000 cash collateral to cover the facility. Which is kinda besides the point. So we never even progressed with that*

We had secured a 5-year low interest N500m (at N10.4m/month) loan for content, but needed a bank guarantee (we are long Naira debt) in order to access it. Remember, we passed through N645m and $2.25m through their accounts last year. Zenith Bank refused. They needed collateral. Cash or assets. They needed N600m equivalent in cash or land. My account officer literally told me he needed ‘Something tangible’

Tangible — ˈtan(d)ʒɪb(ə)l/

noun

a thing that is perceptible by touch.

“these are the only tangibles upon which an assessment can be made”

On the role of Nigerian banks with small businesses:

The Nigerian banking system for me is like Nigeria. It has basically failed. If I could, I would keep my money under the bed. I would get the exact same return on interest. I would probably be able to access it more readily. And finally, I wouldn’t have to put up with the BS marketing campaigns about supporting Nigerians in fulfilling their dreams. Rather than marketing about how supportive they are, they should go ahead and be supportive. If you are a top 100 company, they kneel at your feet. If you are one of the hundreds of thousands of regular SMEs (irokotv.com Nigeria is an SME) then you’re on your own.

I actually don’t need the Nigerian banks. But many, many others do. They don’t have the opportunity to tap international capital. They are stuck with the Nigerian banks.

Nigerian banks don’t support. They suffocate.

Read the rest HERE.

***

Are you a small business owner or a professional just trying to improve your quality of life? Can you relate with Jason’s experience?

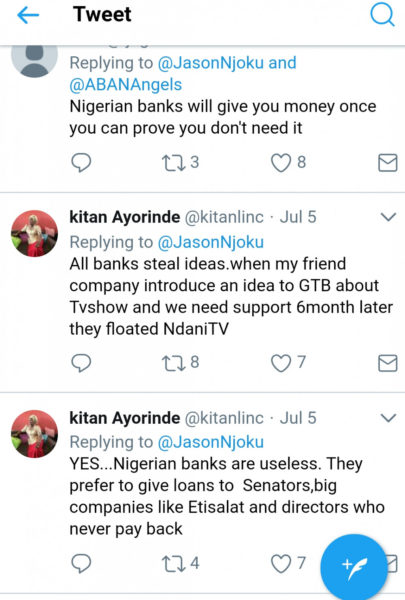

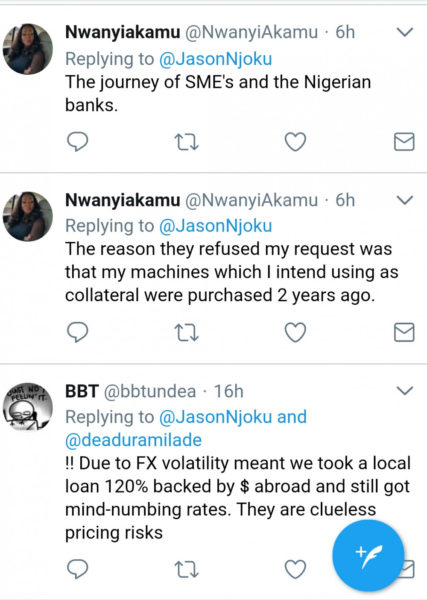

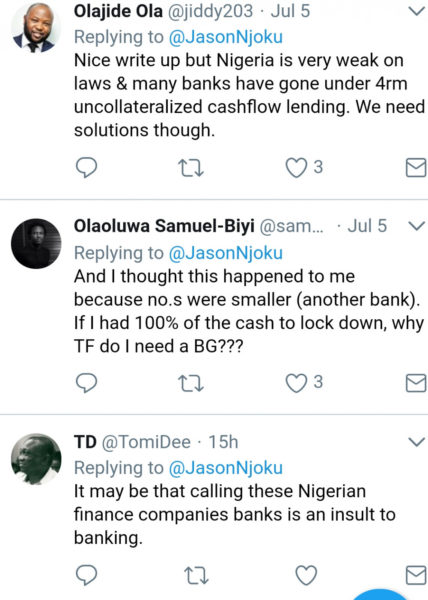

Here are some reactions of TwitterNG to Jason’s article:

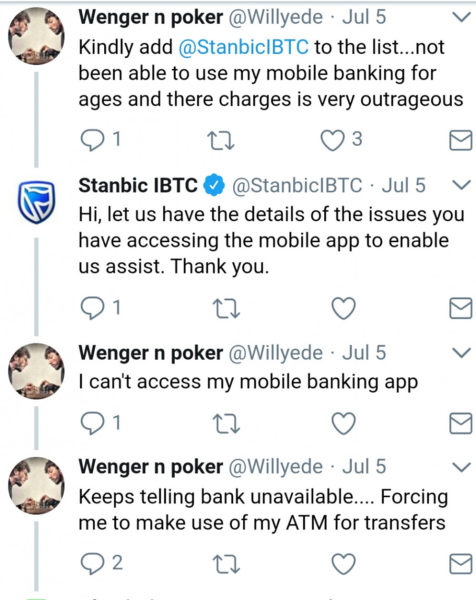

On a lighter note, see how one bank did not want to get caught in the crossfre:

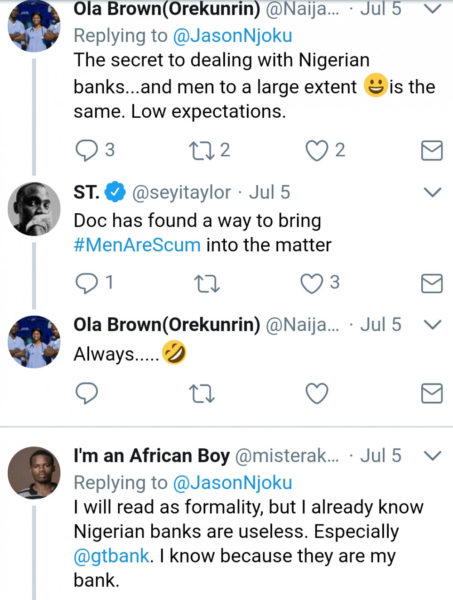

Of course #MenAreScum entered the matter…. somehow

You gotta love Nigerians! Anyway, back to serious matters. How can we thrive under the current economic climate without the banks?