News

How can Non-Interest Banking Drive Financial Inclusion? Listen to Episode 7 of Financial Inclusion Today on BN

According to the Central Bank of Nigeria (CBN) only 41.6% of Nigerians are considered to be financially included. Financial Inclusion means that individuals and businesses have access to useful and affordable financial products and services that meet their needs – transactions, payments, savings, credit and insurance – delivered in a responsible and sustainable way.

The CBN has an ambitious goal of 80 % financial Inclusion by the year 2020.

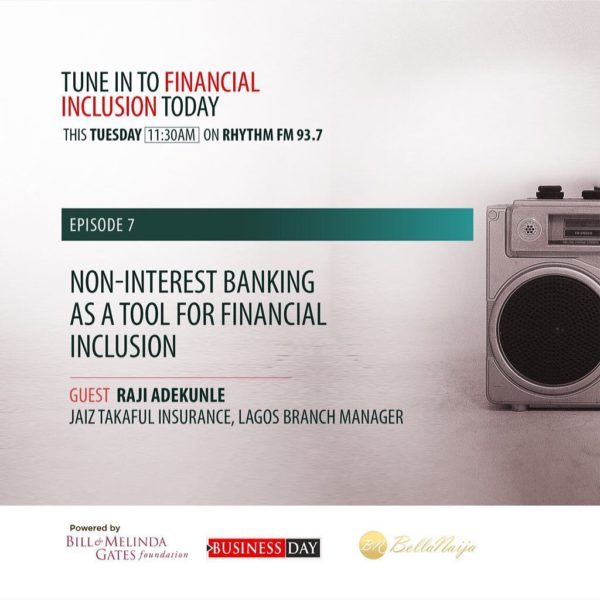

Following a grant from the Bill and Melinda Gates Foundation, Business Day is aiming to drive some of the financial inclusion conversation in Nigeria, and one of the ways is through a radio show titled Financial Inclusion Today. The show airs every Tuesday at 11.30am WAT on Silverbird’s 93.7 rhythm FM.

The shows aims to foster conversations around financial inclusion issues in Nigeria and to raise awareness by bringing together stake holders, decision makers, policy makers, Business Day financial analysts to further this cause in Nigeria.

Episode 7 is titled: Non-interest Banking as a tool for Financial Inclusion

Today’s episode of Financial Inclusion Today, learn about non interest banking/ insurance as a tool for financial inclusion. The term ‘Takaful’ describes a type of non Interest banking.

Takaful is a type of Islamic insurance, where members contribute money into a pool system in order to guarantee each other against loss or damage. Takaful-branded insurance is based on Islamic religious law, and explains how it is the responsibility of individuals to cooperate and protect each other.

The Business Day team of financial analysts Lehlé Baldé, Patrick Atuanya, Lolade Akinmurele, Bala Augie, discuss with JAIZ Insurance Lagos branch manager Raji Adekunle on the topic.

Listen below: