News

How Migrants Abroad Finance Sustainable Families & Communities – Gbenga Okejimi, Country Manager for Nigeria and Ghana, WorldRemit

Family remittances help sustain an estimated one billion people around the world. They are understood to be funds transferred from migrants, who mostly work in high-income countries, to their family or communities in low to middle-income countries.

Family remittances help sustain an estimated one billion people around the world. They are understood to be funds transferred from migrants, who mostly work in high-income countries, to their family or communities in low to middle-income countries.

1 out of every 7 people are directly impacted by these inflows and are able to use funds to supplement their personal income. There is evidence that remittances alleviate poverty and that 75% of remittances received go towards meeting immediate needs like access to food, health care, education and business capital. As such this inflow is a source of sustenance.

The value of global remittances annually surpasses both official development assistance and Foreign Direct Investment (FDI), making remittances a key source of development finance and extremely valuable in low and middle-income countries as they serve in a counter-cyclical capacity during periods of economic downturn.

During the initial months of the COVID-19 pandemic, there were concerns that the global value of remittances might decline. However, a May 2021 report by the World Bank revealed that remittances stayed nearly flat, registering a total figure of $540 billion in 2020. This illustrates the resilience of remittances and the migrants who send them.

Over 200 million migrants in the world make continuous contributions to the well-being of their families and help to improve developmental outcomes. The growth of remittances is dependent on global economic forces, which could spur or hinder the growth of inflows. Economic policies also play a critical role in encouraging remittances into a country from overseas.

We have already begun to see encouraging policies in Nigeria – the largest recipient of remittances in Sub-Saharan Africa – receiving nearly half of all remittances sent to the region in 2019. The Central Bank of Nigeria (CBN), in March, enacted a ‘Naira-4-dollar’ scheme in an effort to incentivize dollar remittances through formal banking channels that allows the CBN to capture such inflows to boost the liquidity of the forex market and ensure the stability of the Naira. The scheme offers recipients of diaspora remittances NGN 5 for every USD 1 received through International Money Transfer Operators (IMTOs) and commercial banks – WorldRemit’s customers are eligible to receive this incentive. It was introduced to support the economy and can have the added effect of increasing access to finance and deepening financial inclusion.

We have already begun to see encouraging policies in Nigeria – the largest recipient of remittances in Sub-Saharan Africa – receiving nearly half of all remittances sent to the region in 2019. The Central Bank of Nigeria (CBN), in March, enacted a ‘Naira-4-dollar’ scheme in an effort to incentivize dollar remittances through formal banking channels that allows the CBN to capture such inflows to boost the liquidity of the forex market and ensure the stability of the Naira. The scheme offers recipients of diaspora remittances NGN 5 for every USD 1 received through International Money Transfer Operators (IMTOs) and commercial banks – WorldRemit’s customers are eligible to receive this incentive. It was introduced to support the economy and can have the added effect of increasing access to finance and deepening financial inclusion.

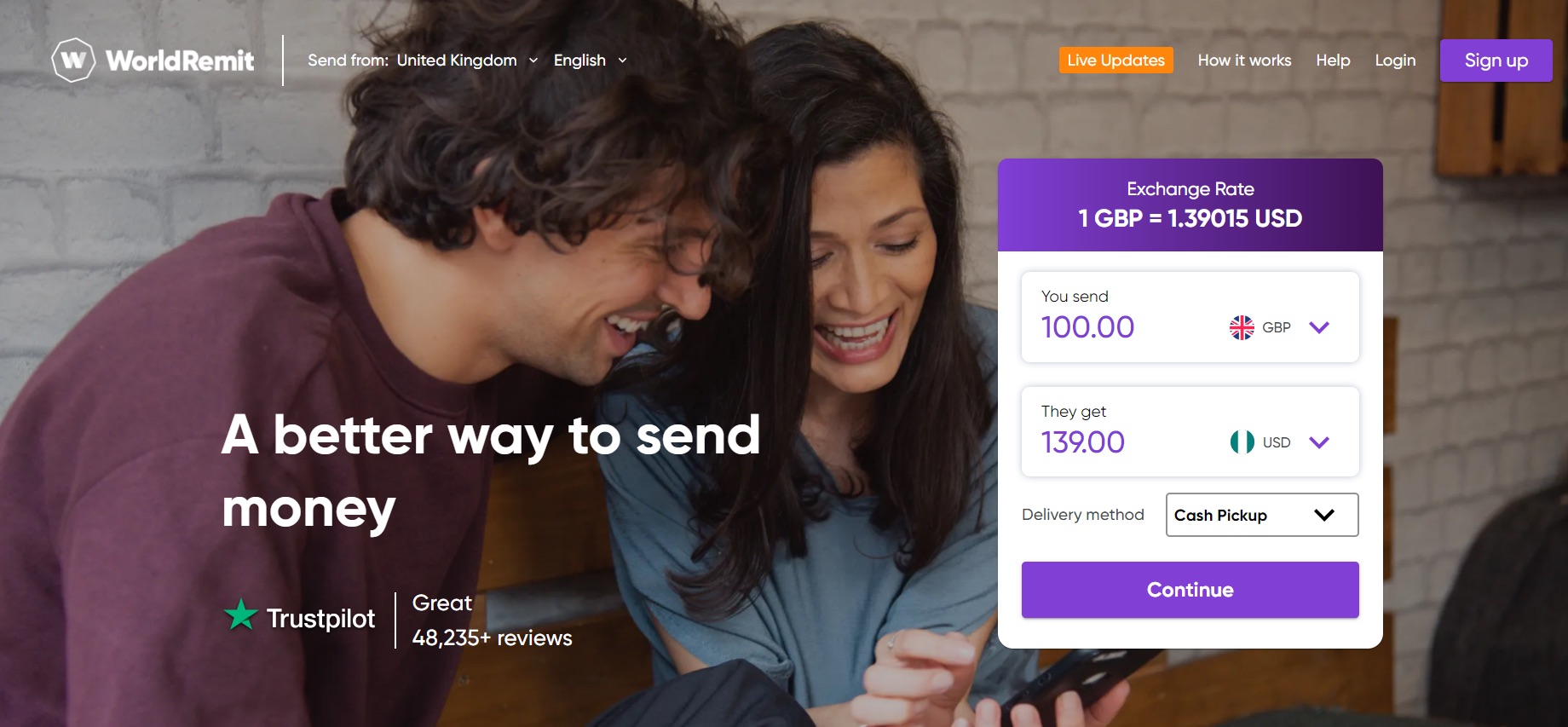

Digital channels serve as one of the most effective solutions to many financial access challenges – this is why WorldRemit is designed as a fully digital platform through which users can transfer funds conveniently, quickly and safely. There continues to be an improvement in the number of people embracing digital financial solutions.

According to EFInA’s Access to Financial Services in Nigeria 2020 survey, the number of people who own mobile phones increased from 85% to 89%, active digital financial services users grew from 16% to 28% while remittances through digital financial channels grew from 22% to 25% between 2018 and 2020. By incentivizing migrants in the diaspora to make money transfers using digital channels, countries can record higher inflows of remittances and a deeper level of financial inclusion can be achieved, as recipients of remittances will also be incentivised to set up formal banking channels.

Governments can leverage this to increase access to financial services in rural and underserved communities, by providing the requisite digital infrastructure and learning required. Providing better opportunities to save or invest, which would increase resilience. It also encourages migrants to develop productive assets in their home countries that can be managed from abroad.

Using international digital money transfer platforms like WorldRemit, Nigerian migrants can contribute more wholesomely to the well-being of their family members and increase the overall value of remittances as development finance. They can encourage more unbanked Nigerians to become banked, which has a ripple effect of increasing the use of digital financial services.

Using international digital money transfer platforms like WorldRemit, Nigerian migrants can contribute more wholesomely to the well-being of their family members and increase the overall value of remittances as development finance. They can encourage more unbanked Nigerians to become banked, which has a ripple effect of increasing the use of digital financial services.

Migrants themselves can also deploy remittances as capital investment, giving them an incentive to one day return home. In alignment with this year’s International Day of Family Remittances (IDFR) theme ‘recovery and resilience through digital and financial inclusion, governments in Sub-Saharan Africa must continue to enact favourable policies to harness the full potential impact of remittances.

________________________________________________________________

Sponsored Content